A foreign-exchange chart in “high-vol mode” can feel like a speeding bullet train: thrilling when you’re on the right side of the move, terrifying when you’re caught on the tracks. Volatility amplifies both profit and peril, and that’s why a stripped-down yet robust skill set matters more than a basket of exotic indicators. Below, we focus on three core pillars that truly move the needle: understanding market catalysts, engineering airtight risk management, and fortifying trading psychology. Nail these, and you’ll be positioned to treat volatility as a business opportunity rather than a random storm.

Master the Market Catalysts

Volatility rarely appears out of thin air; it erupts when expectations collide with reality. Knowing when that clash is likely to happen, and how big the sparks may be, gives you a decisive edge.

Track High-Impact Events Like a Meteorologist

Every serious trader keeps an economic calendar, yet few use it to its full potential. Move beyond simple “red-flag” icons and build a weekly roadmap:

● Circle the Tier-1 events: central-bank meetings, CPI releases, NFP, flash PMIs.

● Note the exact release time in your platform’s time zone to avoid sleepy miscalculations.

● Check the consensus figure and the previous reading, jotting them into your journal before the week begins.

Why so much prep? Because the market’s real fuel is surprise. For instance, a bold 0.2% beat or miss on U.S. headline inflation can remake interest-rate expectations in minutes, often stretching EUR/USD or GBP/USD well beyond their normal intraday range.

Want to sharpen your edge even further? A free Forex course dives deeper into these dynamics, helping you decode economic data and time your trades with confidence.

Measure Consensus vs. Surprise, Not Just the Number

Imagine CPI comes in at 4.4 % when everyone expects 4.2 %. On the surface, “4-handle inflation” looks old news, but that 0.2 % overshoot (there’s your second statistic) prompts algorithmic desks to reprice bond yields and, by extension, dollar pairs. When you hear the number, your first thought should be: “How far from consensus is this, and does it change the central-bank script?”

Use Volatility Gauges to Set Expectations

Keep an eye on the currency options market. If one-week implied volatility for USD/JPY jumps from 9 % to 12 %, you can reasonably expect wider spreads and faster spikes. As a rule of thumb, ATR (Average True Range)often doubles during geopolitical or monetary-policy shocks; seeing it leap from 50 to 100 pips is your cue to widen stops and cut size.

Command Your Risk Blueprint

Spectacular moves mean nothing if you blow up on the first bad trade. A bulletproof risk plan is your seatbelt and helmet rolled into one.

Position Sizing Formula: The Math That Saves Accounts

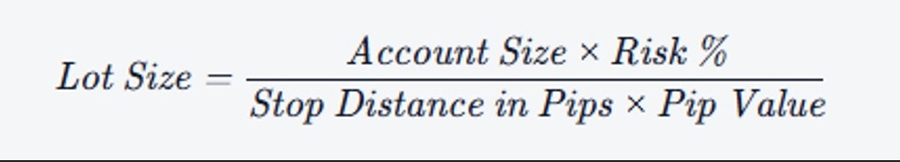

Start with a fixed-fraction risk model. Most retail traders talk about “one-lot trades” without knowing how much money is really at stake. Instead, calculate lot size like this:

If you aim to risk 1 % on a $5,000 account with a 40-pip stop, the formula ensures you never slip beyond your comfort zone even when spreads balloon. In extremely volatile weeks, many pros halve that risk to 0.5 %, acknowledging that the market, not their ego, sets the rules.

Smart Stop Placement: Structure Over Random Pip Counts

Volatile price swings hunt cheap, obvious stops for sport. Anchor yours behind real structure: prior swing highs/lows, unfilled gaps, or a confluent Fibonacci cluster. If GBP/USD is sprinting upward ahead of a Bank of England announcement, placing a stop right below a fresh breakout level is asking to be clipped. Tuck it behind the last authentic pivot instead even if that means reducing your size to keep risk constant.

Leverage and Daily Loss Limits: Two Non-Negotiables

Brokers may advertise 1:500 leverage, but that doesn’t mean you have to use it. Capping total portfolio leverage at 1:20 keeps margin calls at bay when spreads widen without warning. Just as vital is a daily loss limit; a bold 3 % of account equity is a popular ceiling. Hit it, step away, and schedule your post-mortem for later. No heroic comebacks; your future self will thank you.

Fortify Your Trading Psychology

You can have the sharpest analysis on the planet, but panic or FOMO will still nuke your equity curve. Building an internal circuit breaker is as critical as any external rule.

Pre-Trade Rituals to Tune Out Noise

Start each session with a five-minute physical and mental check-in:

- Are you rested?

- Is today packed with back-to-back Tier-1 events?

- What’s the directional bias from the daily chart?

Writing short answers primes your brain for deliberate action, not impulse.

In-Trade Emotional Guardrails

Create “if-then” scripts. For example: “If EUR/USD pierces the 1.0900 psychological level by more than 15 pips, then I’ll wait for a 15-minute candle close above it before entering.” This simple sentence acts as a mental speed bump. The market might zoom past your level, but you’re programmed to wait for confirmation rather than chase candles.

Parallel to that, keep a real-time checklist next to your keyboard:

- Has the stop moved without justification?

- Has size been added mid-trade?

- Is the initial thesis still valid post-news?

If any answer drifts from your plan, flatten the position.

Post-Trade Review Loop

The session isn’t over until your journal entry is done. Grab a screenshot of each trade, annotate why you entered, where you exited, and how you felt. After ten trades, patterns jump off the page: maybe late-New-York entries are consistently poor, or winning streaks tempt you to upsize recklessly. Data-driven insight beats foggy memory every time.

Final Word

Trading a volatile FX market is not about predicting every twist; it’s about preparing for a handful of predictable scenarios and executing with discipline. First, know the catalysts that can explode a pair’s range and limit your surprises. Second, engineer a rock-solid risk framework so no single trade or even a bad day can cripple your account. Finally, strengthen your psychology through rituals, guardrails, and honest review. Do these three things consistently, and volatility becomes less an unpredictable monster and more a well-paid sparring partner.