Vietnamese electric vehicle manufacturer unexpectedly emerged as one of the most valuable carmakers in the world. When we are writing this article, VinFast’s capitalization is being exceeded only by Tesla and Toyota. But chances are, you've likely never even heard of this company. So, it’s time to remedy the omission and decide if investing in VinFast stock could be a smart move.

VinFast is a Vietnamese company and a part of Vingroup, engaged in multiple fields of activity – from cybersecurity and electric cars to pharmaceutics, real estate, and fashion. Just to clear things up, of course, the naming of every subsidiary starts with Vin.

VinFast began with car sales, later securing a license from BMW to manufacture their vehicles. In 2022 the company decided to do away with internal combustion engine autos in favor of electric cars. VinFast’s electric cars didn't completely make the running (and raised some regulatory questions). Nonetheless, on August 15, the company went public via SPAC merger, and its stock belongs to the trendiest in the market.

By the way, if you want to find trendy or promising shares easily, you can use stock screener. This tool generates lists of stocks to match your criteria.

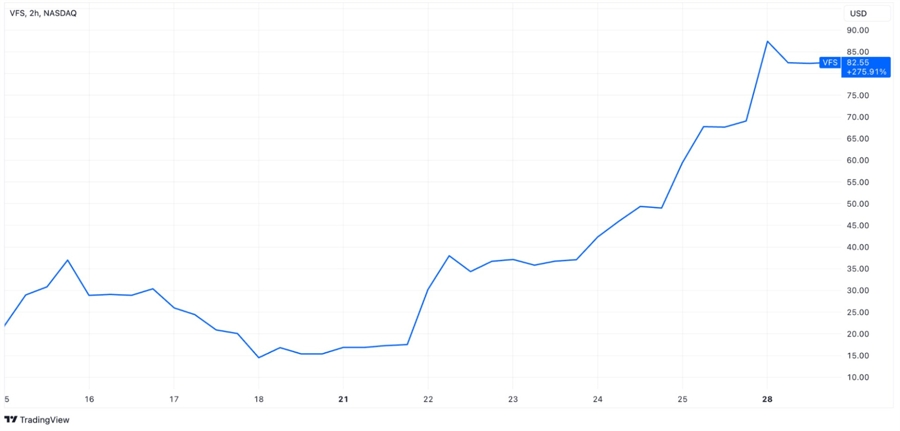

But let’s get back to VinFast and its shares. Since the IPO, they have been extremely volatile. One might say that it’s pretty typical. An IPO, electric vehicles, hyped brand name – these are all core elements of a trader’s starter pack. But a little-known Vietnamese company that managed to become the world's third-largest carmaker by market cap for no clear reason is not a common case. Just take a look at the chart (disclaimer: the situation might change fast; therefore, we can’t guarantee that you are not witnessing VinFast’s stock steep drop right now).

Could there be some hidden drivers pushing stocks to new heights? Well, one of the possible reasons is that the company is building a factory in North Carolina. Moreover, VinFast's magnet supplier, Star Group, is planning to invest in a new plant in Vietnam. On top of that, the Vietnamese market could become an interesting alternative to the Chinese car market.

All that's been said is nice. But, honestly, these drivers don't seem to justify a $160-mln market capitalization. Simultaneously, VinFast reported losses exceeding $2 billion last year. In 2023, the carmaker is aiming to sell about 50,000 vehicles. For comparison, Tesla's plan is nearly 1.8 million vehicles. And don’t forget that the economic situation worldwide is indisposed to the growth in car sales.

In other words, there is almost no obvious explanation for the current VinFast stock price. EV makers are gearing up for the future, and VinFast may become one of the symbols of that future, who knows. But right now, it’s more of a story about highly volatile stock, where investing and trading might come with a fair share of risks. As you understand, it means potential profits and potential losses are of the same probability.

So, be careful and conduct your thorough analysis before making deals with VinFast stock. Just as you would with any other ones.