A potentially looming crisis in the US presents an opportunity to find stocks that can defy prevailing trends in tough times and might be underestimated right now. Target Corporation appears to possess both of these characteristics. Let’s try to investigate if it’s true and whether investing in Target is a prudent idea.

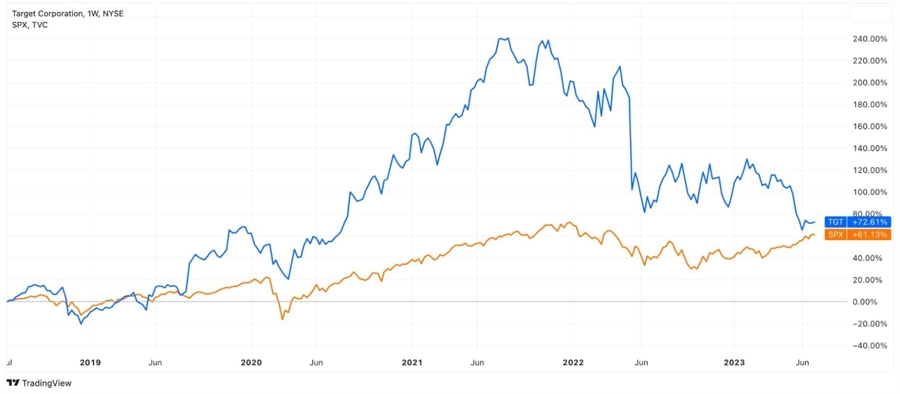

Target ranks among the top 10 of the biggest retailers in the US, with nearly two thousand stores and diverse avenues for online orders. The latter aspect positioned Target favorably during the pandemic. A noticeable gap between Target stock and the S&P 500 index can be observed in 2021.

With the end of the Covid pandemic, financials deteriorated after a temporary surge. Add here an image scandal – and you get a large business on its lows. The chart showcasing this year's movements helps to see the last months in detail. Additionally, if you seek other undervalued stocks, you can use stock screener, a tool that generates lists of stocks based on your filters.

Stocks from the consumer goods segment are traditionally deemed a good choice in crises. When people have less free money, they don’t cease going to supermarkets or making online orders. Instead, they seek discounts and special offers, and Target emerges as a valuable ally in such circumstances. A scaled chain of stores enables the company to seamlessly integrate its online and offline capabilities, facilitating a more efficient working process.

The other fact you need to know is that Target has been paying dividends for 50 more years, presently yielding 3.32%.

Nevertheless, Target's recent financial reports failed to impress market participants. In 2022 the company’s revenue increased only by 2.9% compared to 2021, while net income experienced a 60% decline during the same period.

Another unfavorable factor is a dependence on discretionary product sales. Although selling a multitude of goods within a specific category is advantageous, crises prioritize essential items.

Analysts consider that Target stock holds promise as an investment option. The consensus forecast suggests a 31% increase in the next 12 months with a rating “Buy”. This is a remarkable target given the current state of the US economy.

However, it is crucial to remember that trade decisions should be made following meticulous personal analysis. If Target or any other stocks appear to have more negative aspects than positive ones in your eyes, it’s best to abstain from including them in your portfolio.