I've been thinking about this Pan Am advertisement from 1963, and it strikes me that we don't talk enough about what an absolute miracle modern aviation represents. Not just as a technological achievement, but as perhaps the single greatest example of what happens when you get the regulatory framework right and let competitive capitalism do its work.

There are plenty of things humans have built that are bigger, faster, richer, louder. But if you want the single best case that we can scale competence — across countries, languages, weather, fatigue, politics, and entropy — it’s safe, commercial aviation.

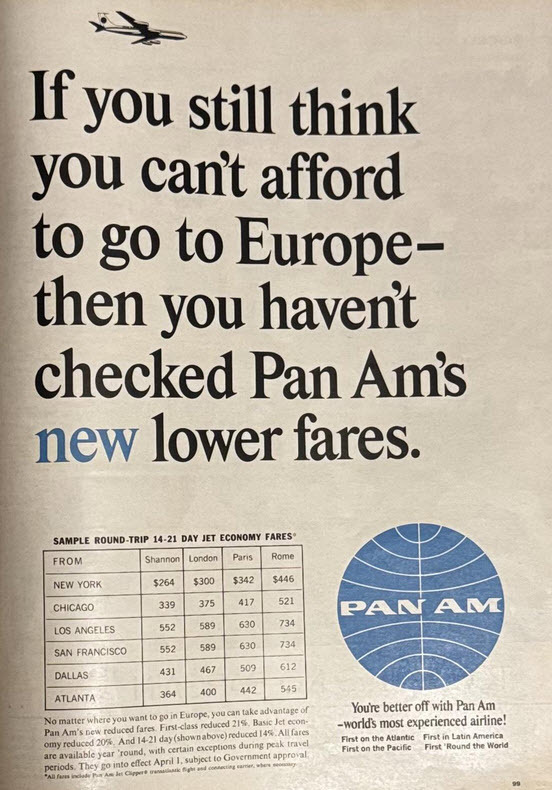

Check out the fares in the table.

Look at those fares. New York to London for $264 round trip in 1963. Adjust that for inflation and you're talking about roughly $2,700 in today's money. Now pull up Google Flights and you can find that same route for $500, sometimes less if you're flexible. That's an 80% reduction in real terms for a service that's simultaneously become safer, faster, and more reliable. Show me another industry that's pulled that off while also making their product better.

Look at it this way:

1963: It took 120 hours of work to buy a ticket.

Today: It takes roughly 20 hours of work to buy a ticket.

That is an 80% collapse in real cost. It is a massive explosion in global mobility and standard of living.

The Nexus of Regulation and Capitalism

This is where the lesson for markets gets interesting. Aviation is arguably mankind's greatest achievement not just because we conquered gravity, but because we conquered the economics of risk.

This industry sits at the perfect, messy intersection of heavy regulation and ruthless capitalism.

On one side, you have the regulators. They are slow, bureaucratic, and unflinchingly strict. They force redundancy. Aviation is regulated like religion. They make safety non-negotiable. If planes crashed with the frequency of 1960s automobiles, the industry wouldn't exist. Regulation created the trust asset that allows the market to function. It also shows that regulation can work for consumers and industry.

The safety record is almost absurd when you think about it. Commercial aviation is so safe now that you're more likely to be killed by a vending machine than in a plane crash. We move 4.5 billion passengers a year through the air in metal tubes at 35,000 feet, and fatal accidents are so rare they make global headlines when they happen. In 1963, the fatal accident rate was about one per million flights. Today it's closer to one per seven million. All while ticket prices collapsed.

On the other side, you have capitalism. It's brutal. Look at Pan Am—the company in the ad. They are gone. Bankrupt. Creative destruction took them out. But the fierce competition for efficiency—better engines, fuel economy, turnaround times, and yield management—drove the costs down relentlessly.

The consumer won. The shareholder of Pan Am lost, but the global economy gained a massive deflationary tailwind.

The Market Lesson

The next time you see a headline about how regulation kills growth or how capitalism is failing the average person, look at a plane. . Heavy regulation isn't inherently bad for consumers, and light regulation isn't inherently good.

We are flying in tubes at 35,000 feet, sipping tomato juice, statistically safer than we are sitting in a taxi, for a fraction of the cost our grandparents paid.

Compare this to healthcare in the US, where they've somehow managed to regulate in ways that increase costs while producing worse outcomes than peer countries. Or look at housing, where local regulations often prevent the very competition that would bring down prices. We regulate the wrong things, or we regulate in ways that entrench incumbents rather than ensuring baseline safety and quality.

Capitalism is the compounding engine. Once the safety floor is credible, competition can do what it does best: squeeze cost out of the system while preserving the product people actually care about (getting there safely and on time). Airlines fight for passengers, aircraft makers fight for orders, engine makers fight for fuel burn, lessors fight for financing spreads, airports fight for routes, and everyone fights for reliability because reliability is what lets you sweat the assets. Safety is non-negotiable; everything else becomes a productivity war.

And that productivity war shows up in the most powerful scoreboard we have: price.

Where it doesn't show up is in shareholder profits. Airlines are a notoriously tough industry but that's how it should be. Capitalism is supposed to be hard and not a never-ending gift to the monied class.

This is not how it's supposed to work.

The long-term chart of human progress is the ultimate "up and to the right" trade. It’s messy, it has drawdowns, and individual companies go to zero. At some point economies are going to get this right because everything in capitalism should look like aviation. It's a similar product with the marginal dollar being competed for ruthlessly.

Imagine that.