Sometimes, almost everyone gets in the mood for a Pepsi or McDonald's. You know, such an internal craving for fast food or sugary beverages for no explicable reason. However, these days, people choose healthier food options more frequently. Surprisingly, this shift is also benefiting PepsiCo – the company’s recent financial report proves it. Let's find out why the stocks went up, yet analysts revised their predictions.

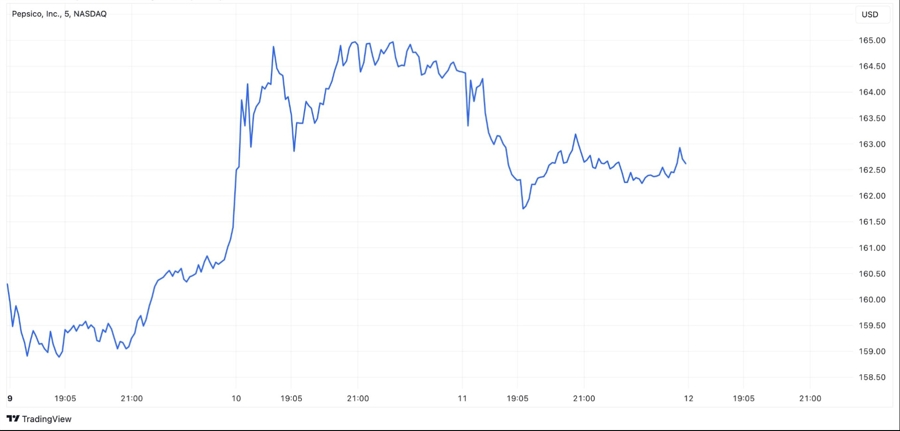

The chart below illustrates the market’s response to PepsiCo’s report. The stocks hiked by about 2%. Not a substantial increase, but it could present a reasonable trade opportunity. To find more such opportunities, or even more impressive ones, you can use the earnings calendar, which shows all the upcoming significant and minor reports.

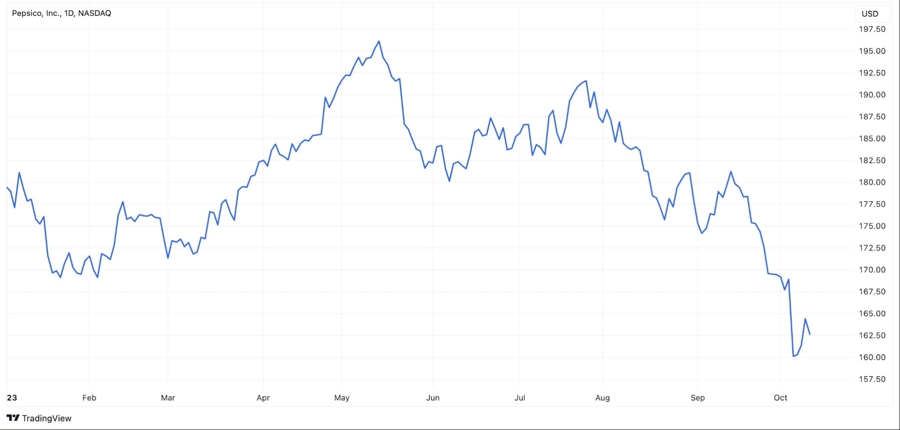

Anyway, 2% is a decent gain, yet there is room for more. What about a longer timespan? It's evident that PepsiCo stocks have displayed a downward trend throughout this year.

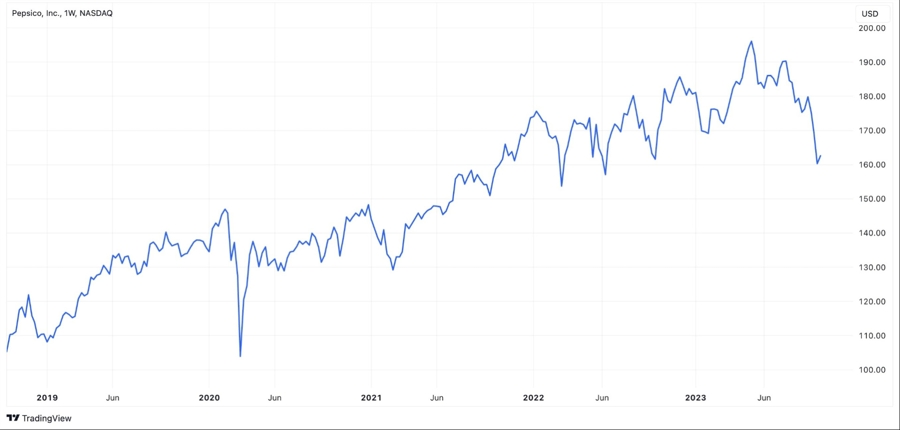

Nevertheless, generally, these shares belong to the group of assets capable of generating profit over years and even decades due to the robust business and brand power.

PepsiCo’s surpassed both expectations and the figures from the same quarter a year ago. The Q3 revenue reached $23.15 billion slightly below the estimated $23.41 billion but exceeding the previous year's $22 billion. Earnings per share stood at $2.24 outperforming the anticipated $2.15 and the last year's $1.97. Besides, the company increased its full-year guidance.

The critical factor behind these impressive stats is the price increase for PepsiCo’s products. Furthermore, several notable trends are emerging in the beverage and food industry, as well as in supermarkets and related sectors.

First, there is an evolving tendency in favor of healthy food, sugar-free drinks, and smaller packs. PepsiCo is actively developing these lines, enabling the company to remain adaptable and generate profits in various scenarios.

Secondly, the company’s representatives highlighted that urbanization and modern world rules often lead customers to opt for snacks instead of a full meal.

Even though PepsiCo's stocks saw a modest increase following earnings, many analyst companies adjusted their forecasts. Notably, Morgan Stanley lowered their target from $210 to $190, Citigroup from $200 to $180, and JPMorgan from $188 to $185. However, the consensus forecast based on analysts' opinions suggest that PepsiCo shares are still traded below their fair value, with the potential for a 17% increase over the next 12 months.

Please remember to do your own research before making any stock-related decisions.