What filters do you use on Airbnb to find great accommodations at an extremely low price? Share your secret? But here's the bad news – no matter what filters you apply, you can't find Airbnb stock at a low price anymore – the papers are way up in early 2023. So, is it too late to add Airbnb to your portfolio, or can you still make it to the party?

In 2022, the last Covid restrictions around the world have been lifted or at least eased. For the tourism industry, this means a big comeback. People are traveling, planes are flying, and the swimsuit category is once again labeled “Popular” on the marketplaces. Everyone missed traveling during the pandemic, so for airlines and services like Airbnb, opening the borders is a big boost.

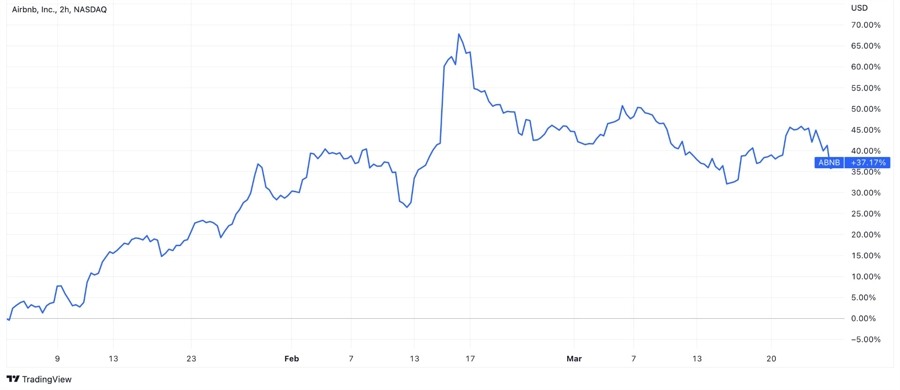

When talking about Airbnb, this theory was proven by a report published in mid-February. You can see its impact in the chart below. But also keep in mind that it is not only financial reports that affect the stock price. It can also be various economic events, such as the Fed's actions. To make sure you don't miss anything, you can use trading tools such as the economic calendar.

According to the report, after suffering a $350 million loss in 2021, Airbnb posted a profit of nearly $1.9 billion in 2022, surpassing expectations. Vacation rental company’s significant gains are also evident when comparing actual and estimated earnings in Q4 2022 – $319 million against $171 million.

That said, the company still has room to grow. The abovementioned excellent results were achieved almost without the participation of Chinese tourists, because in China the Сovid restrictions were lifted only towards the end of last year. Therefore, we can assume that demand for Airbnb services will continue to grow. Moreover, the firm renewed the upside for its Q1 2023 revenue from $1.75 bn to $1.82 bn, whereas analysts only estimated $1.69 bn.

So are there only pros? Well, the price-to-earnings ratio for Airbnb is 43, and some experts consider that number too high for investment. Also, the company may meet restrictions in some regions where short-term rentals may be prohibited, but that's not common.

That's why the consensus forecast for Airbnb stock is +19% over the next 12 months. That doesn't mean, of course, that you should buy this or any other stock that analysts have pointed out. You should do your own research first and only then make the decision to buy or sell the stock or leave it alone altogether (which is sometimes the best decision of all!).