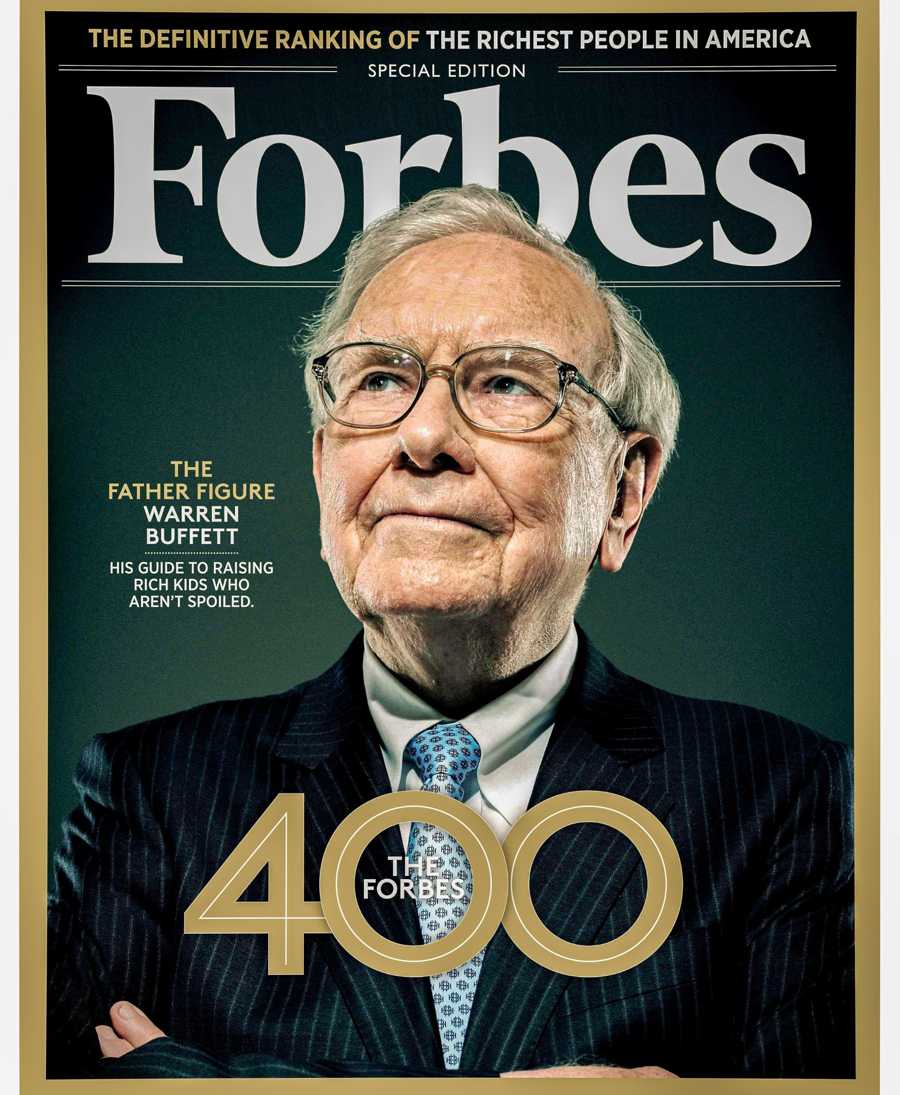

Why Warren Buffett Says “Never Lose Money” — And What He Really Means

A deeper look at one of the most quoted — and misunderstood — rules in investing.

"Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1." — Warren Buffett

What “Never Lose Money” Actually Means

Buffett isn’t saying you’ll never see red in your portfolio. He’s reminding investors that the true danger isn’t short-term drops — it’s locking in real, unrecoverable losses.

That happens when:

You buy a bad business

You pay too high a price

You sell in panic

You take on risk you didn’t understand

Volatility is part of investing. Permanent loss isn’t — if you’re disciplined.

Reconciling the Reality of Red Days

Let’s address the obvious: You’ll almost never buy a stock at the absolute bottom. That means it’s common to see a small unrealized loss shortly after entering a position.

So how does that square with "never lose money"?

It’s about perspective and intent:

Temporary dips aren’t losses — they’re volatility.

Real loss only happens when you sell below your entry for the wrong reasons.

If you’ve bought a strong business at a fair price and your thesis is intact, red days are part of the journey.

In fact, expecting to always be green right after buying is a dangerous mindset. It leads to overtrading and second-guessing. The wiser approach? Let the business play out, and focus on not losing money permanently — not avoiding every short-term dip.

Why Young Investors Need to Hear This Early

When you’re starting out, it’s easy to:

Chase hype

Ignore valuation

Panic during a drawdown

Forget that stocks represent real businesses

Buffett’s rule forces you to think long-term. It nudges you to ask:

What am I really buying?

What could go wrong here?

Would I still want this company if the price dropped 20% tomorrow?

How to Apply Buffett’s Rule in Real Life

1. Understand the business before buying the stock

Don’t just follow a trend — know what the company actually does and how it makes money.

2. Buy with a margin of safety

Even great businesses can be terrible investments if you overpay. Give yourself a buffer.

3. Avoid high-risk situations you don’t fully understand

If it sounds too good to be true, it probably is. Buffett avoids complex bets — and so should you.

4. Think about capital preservation first

Your job isn’t to swing at everything. It’s to protect your base — and grow it patiently.

Real-World Example

Let’s say you’re looking at a tech stock that’s doubled in six months. It sounds exciting. But ask yourself:

Is the business model solid?

Are earnings growing — or just the hype?

If this stock dropped 30%, would I understand why, or would I panic?

A disciplined investor might pass — not because they’re scared, but because they’re focused on avoiding a bad outcome.

📚 Analogy: Great investing is like climbing a mountain. Getting to the top is important — but not falling off along the way is what keeps you alive.

Quote to Remember

"The first rule of compounding: Never interrupt it unnecessarily." — Charlie Munger

Read Next:

How to Use Technicals & Fundamentals Together (Coming Soon)

Buffett on Cash, Patience, and Optionality (Coming soon)

Brand Transition Note ForexLive.com is becoming InvestingLive.com — bringing you not just fast markets, but timeless investing wisdom from legends like Buffett, Munger, and Marks.

Looking for Timely Stock Trade Ideas? Tired of missing great trades or getting lost in noisy groups?

InvestingLive Stocks delivers free, focused trade ideas right when you need them:

S&P 500 & Nasdaq 100 stocks in focus — including large caps & momentum setups

Unique opportunities you won’t find anywhere else

Fast, actionable, noise-free alerts

Smart entries + smart exits (buyTheDip setups included)

Join free on Telegram: https://t.me/investingLiveStocks