Sunday read for investingLive.com. A reflection on ethics, AI, and what markets might price next.

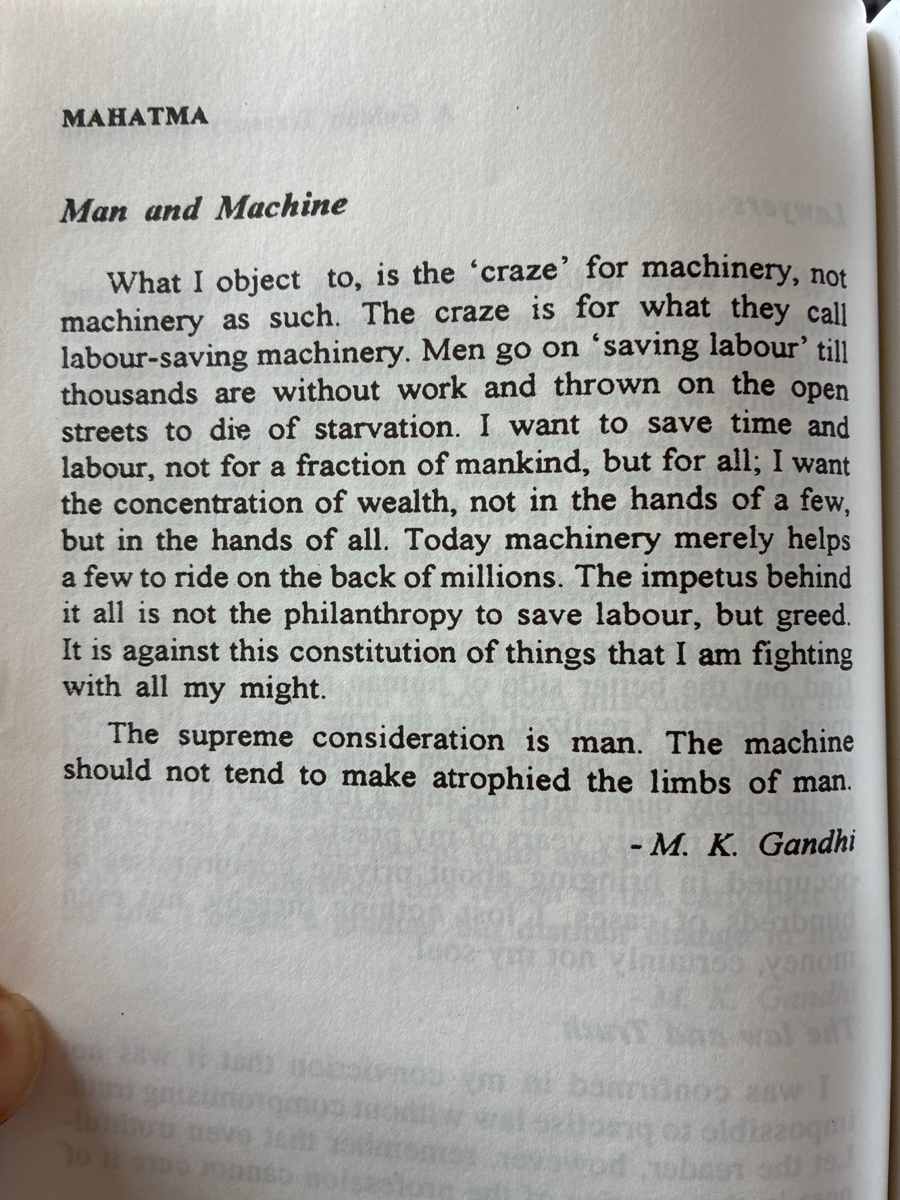

When Mahatma Gandhi warned about the craze for machinery, he did not reject progress. He rejected a mindset that allowed tools to serve greed rather than humanity. Replace the loom with a large language model and the message still holds. Artificial Intelligence can lift productivity and profits, but it can also erode purpose, dignity, and trust if it is guided only by efficiency.

Gandhi’s test was simple: the supreme consideration is man. In today’s language, the question becomes practical for both investors and innovators. Does this company’s intelligence empower people or quietly replace them?

Is AI the "new craze for machinery"?

AI has become one of the biggest drivers of global market growth. Trillions in new market capitalization have been added by companies building or using it. The logic is clear. Software that can design, write, sell, and predict promises unmatched leverage. Yet Gandhi would have reminded us that efficiency often hides imbalance.

When productivity gains come at the cost of mass displacement, social trust weakens. When a few firms accumulate disproportionate control of algorithms and data, concentration grows. When trust falls, valuations follow.

What may come next is what already happened with sustainable investing

History offers a useful guide. Sustainability began as a moral discussion about the environment and became an economic factor shaping both portfolios and consumer habits. A similar transformation may await AI ethics. The more visible the misuse of AI becomes, and the more the public connects job losses or bias to corporate actions, the more ethics will become an economic consideration.

Two forces could drive this shift.

First, consumer choice. Users will increasingly choose AI tools and digital platforms that respect privacy, safety, and fairness. Switching costs are low; boycotts and backlash spread fast. Trust will become a competitive edge.

Second, generational capital. Gen Z investors are already values driven. As they grow into decision makers, expect them to seek companies whose AI strategies align with social responsibility. Ethical AI could become the next evolution of ESG thinking, where investors reward conscience along with competence.

How AI ethics may get priced

Markets tend to quantify what matters. At first, the metrics for AI ethics may seem abstract, but they will mature over time. Analysts and fund managers might begin to monitor data points such as:

• The share of automation budgets used to augment rather than replace jobs.

• The investment in retraining and human upskilling programs.

• The transparency of model safety reports and independent audits.

• The treatment of data ownership, consent, and privacy.

• The energy and compute efficiency of model development.

Firms that treat these as core disciplines, not compliance checkboxes, could gain what we might call a trust premium. Those that neglect them could face a trust discount as customers and investors demand accountability.

The Gandhi test for AI companies

Translate Gandhi’s moral compass into today’s corporate questions:

• Does this product enhance human potential or quietly erode it.

• Do employees displaced by automation have a fair path forward.

• Are model decisions explainable to users.

• Is data collected with consent and fairness.

• Can independent experts verify the safety claims.

Pass this test and the result is more than good ethics. It becomes durable business. Customer trust lowers churn, attracts talent, and shields against regulatory risk.

The investor view

For investors, ethical AI should be tracked early, much like sustainability a decade ago.

• Screen for clear disclosures about safety and retraining.

• Engage through shareholder actions to encourage human-centered innovation.

• Watch for funds or indices that rate companies on AI responsibility.

• Consider that regulation will tighten, and leaders with mature governance will pull ahead.

In financial terms, ethical design may soon carry tangible pricing effects on cost of capital, brand loyalty, and long-term growth potential.

The Sunday takeaway today at investingLive.com

Gandhi did not reject machines; he rejected machines that forgot their purpose. If he lived in the age of ChatGPT, he would likely ask executives, developers, and investors the same question he asked of the industrialists of his time: Does your progress serve humanity or consume it.

For readers of investingLive.com, this question is not only ethical. It is an emerging investment lens. As AI reshapes industries, the balance between intelligence and integrity may decide which companies lead the next decade. Those who align technology with trust will not only stand on moral ground; they may also stand on stronger financial footing.