Gold is more traditional than having corn flakes with milk for breakfast – this precious metal is the number-one choice of investors and regular people in every crisis. Or maybe gold is only believed to be an excellent safe-haven asset.

This question you may ask yourself seems quite reasonable, because if you take a look, you’ll see that the asset that gained the most over the 2022 crisis is the US dollar. But now it’s 2023 and the leader may change. Let’s try to find out who may breast the tape – gold or the USD.

The military conflict between Russia and Ukraine led to crisis for most of the world. Stock markets falling down, crypto falling down, forex falling down… Wish we could say the same about the prices. The global economy is at a low ebb, so people are trying to find ways to save their money. The most obvious choices are the US dollar and gold.

In 2022 the USD outperformed gold for a number of reasons. The first one is the Federal Reserve policy. The US regulator hiked the key interest rate much more actively than other major central banks – the higher the rate is, the more attractive the currency becomes for investors.

Secondly, even without the Fed-policy factor, the USD looks like a safe haven for people that are not sure about the future of local currencies. The dollar is an easy-to-buy and easy-to-sell asset. It has high liquidity in almost every country around the world.

Thirdly, the USA is less affected by the energy crisis and supply disruption than Eastern Europe. It gives the US economy an opportunity to feel at ease.

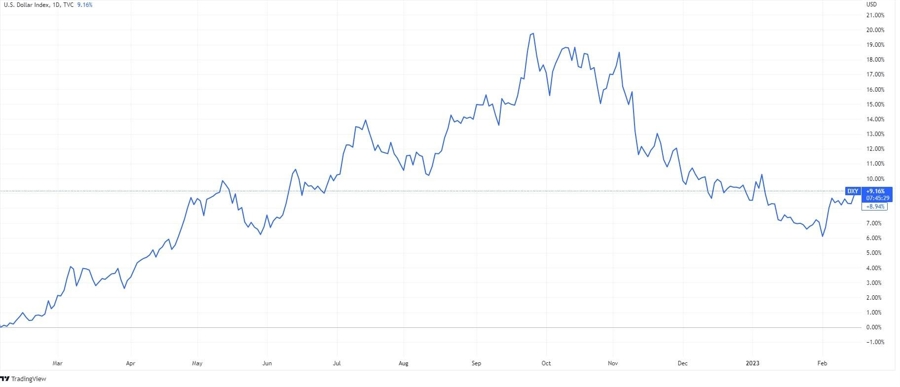

DXY (US Dollar Index) indicates that the USD has grown in relation to the other major currencies by 9% since the beginning of 2022. In pulse torque, this number was near 18-19%. These price movements you can see on the chart below allow traders to get profit. To forecast future market movements you can use different trading tools. It shows all the major economic events that can influence currencies, stocks and bonds.

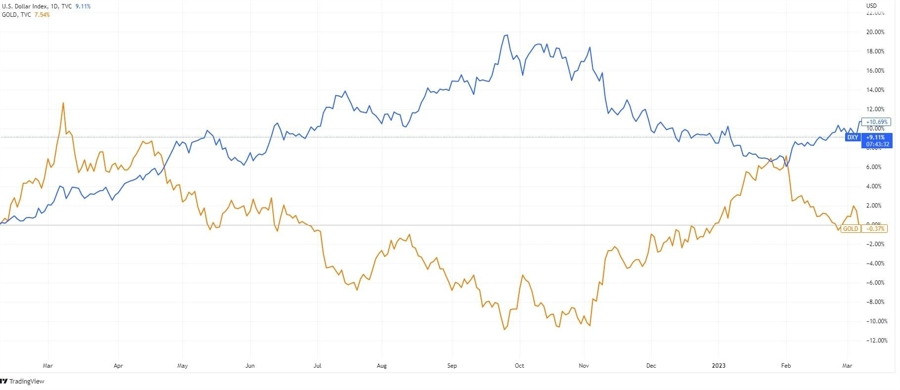

Gold is one more asset that is chosen in crises. Usually, it moves inversely proportional to the USD. We can clearly see that on the chart.

We should realize that the military conflict and the crisis don’t seem likely to come to an end any time soon. It means that defensive assets will be essential for a long time. But the question remains whether the USD will be so impressive in 2023 or not.

As we said above, the dollar had grown by the middle of autumn because the Fed hiked the key rate. In autumn, investors expected that the Federal Reserve would abandon its hiking policy – that’s why the USD rate went down.

The Fed didn’t meet investors’ expectations. Approximately half a year has passed since then but the central bank is still continuing to push up the interest rate. Like King Kong, the Fed is climbing to the top of the tower with the rate in hand, ignoring all the forecasts. But it can’t last forever. It’s likely the Federal Reserve will have stopped raising the rate by the end of 2023. After that, the USD is likely to become less popular among investors.

Moreover, investors already get other alternatives in the Forex market. European currencies feel more confident after the warm winter, and currencies of the emerging markets are supported by easing of the Covid restrictions in China.

The moment the Fed changes its policy, gold may become a more eye-catching defensive asset. Plus, even after the ending of the military conflict between Russia and Ukraine, the world crisis will not die a fast death – that’s why many experts consider gold a great choice in the long term.

As it stands, the price of gold is nearly $1,830 per ounce. Many experts think that by the end of 2023, it may reach $2,000 and then continue its growth. In 3 to 5 years, they expect something closer to $2,500, or even $3,000.

Of course, this doesn’t mean that you need to be in a rush to invest in gold or execute trades with the USD. Global economic conditions are in constant flux. As a result, you should always do your own analysis before buying or selling any asset.