Introduction

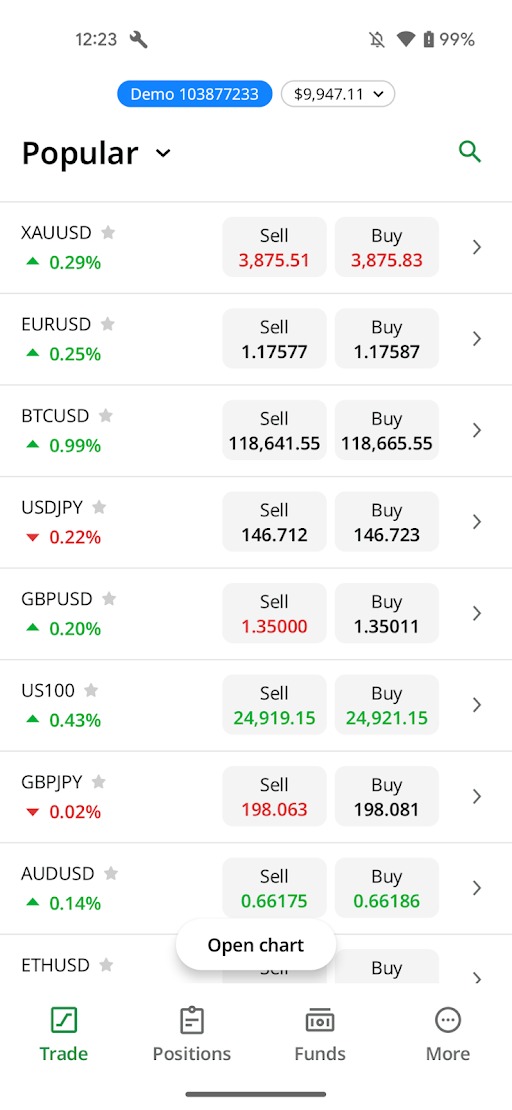

Trading has always been about information and timing. Prices jump, news hits the screen, and charts don’t always tell a clear story. Even experienced traders can struggle to decide what matters right now. For beginners, it’s even harder.

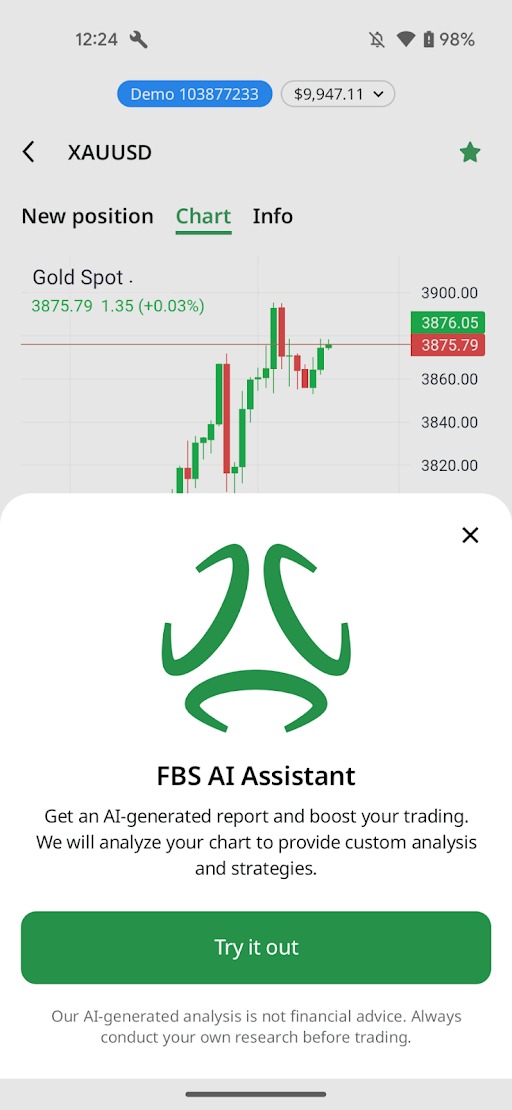

That’s why FBS built the AI Assistant directly into its app. It is designed to simplify complex analysis, highlight where opportunities could be forming, and give traders an extra layer of confidence in decision making. It is more than just another tool, it is a second pair of eyes powered by artificial intelligence that can help you move from uncertainty to clarity.

What is the FBS AI Assistant?

At its core, the FBS AI Assistant is an automated analytical tool that generates trading insights in seconds. Instead of spending hours maneuvering between indicators, you can request a chart analysis with a single tap and receive a structured report in less than 15 seconds.

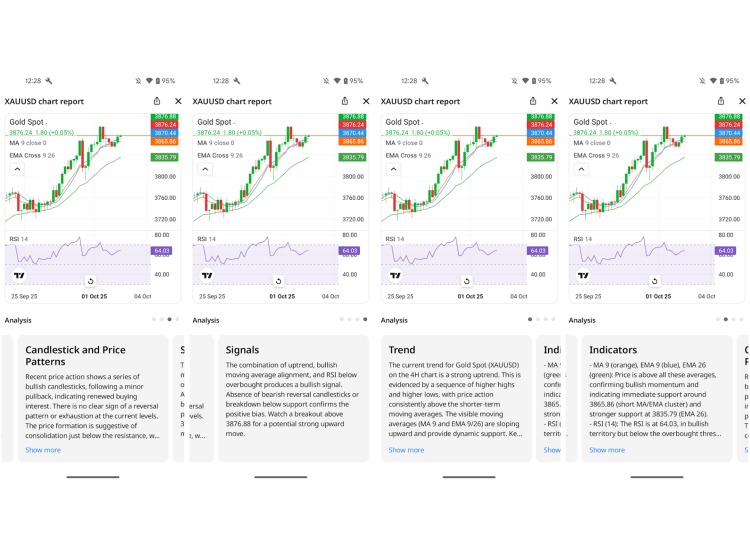

Here is what you get:

Quick market reports: analysis of the chosen chart, including trend detection and potential price movements.

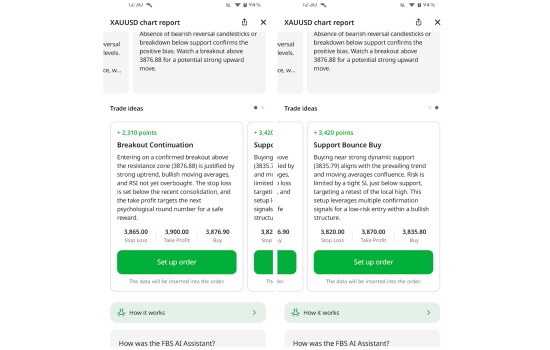

Trading ideas: suggestions with entry points, stop levels, and take-profits that you can place directly from the report.

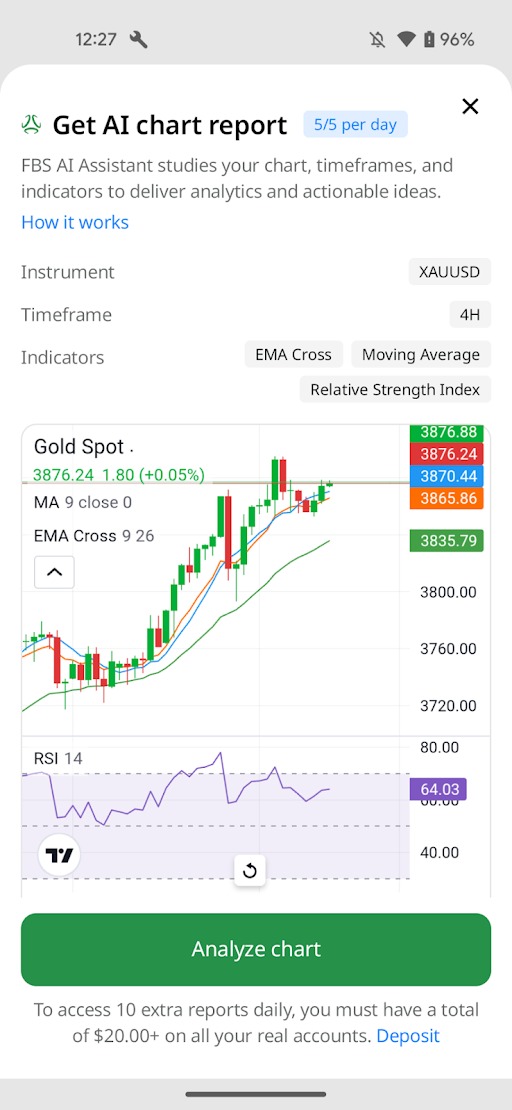

Daily access: 5 free reports every day for all users, and up to 15 reports if your account balance is above $20.

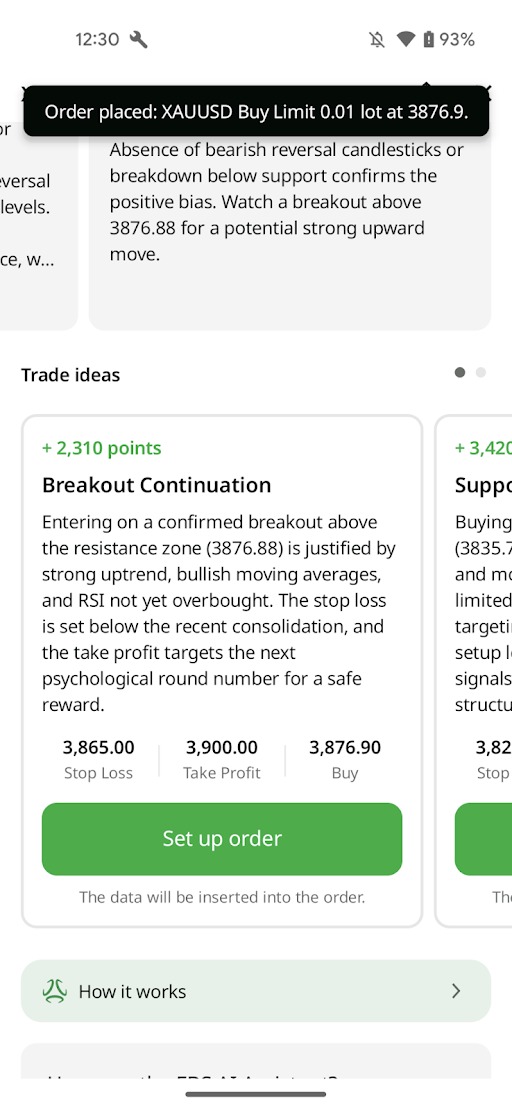

Real-time execution: if you like one of the suggested setups, hit Place Order and open the position instantly.

Each report is unique to the chart and timeframe you analyze. The system always keeps only the most recent analysis, so you are working with up-to-date insights rather than outdated signals.

Importantly, FBS emphasizes that the Assistant does not provide financial advice — it supports your strategy, not replaces it.

How to use it in practice

Getting started takes less than a minute:

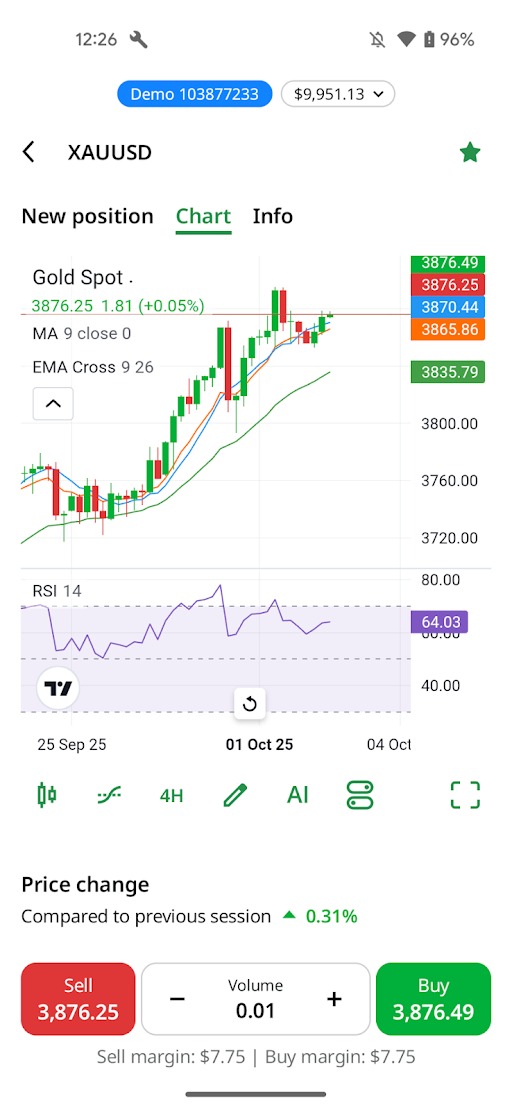

1. Open the chart of the instrument you want to analyze — for example it XAUUSD, EURUSD, or an index.

2. Add 3+ indicators to the chart for better data. For example RSI, MA, EMA Cross.

3. Tap the AI Assistant icon on the chart.

4. You will see how many reports you have left for the day. Tap Analyze chart.

5. Wait a few seconds. The Assistant processes market data and generates the report.

6. Review the results: trend summary, indicators, candlestick and price patterns, and signals.

7. After you review everything, you can choose a trade idea that fits you the best.

8. If one idea fits your strategy, press Set up order to open the position instantly.

Do not stop at one timeframe. Check multiple time horizons — sometimes an intraday signal looks strong, but the bigger picture shows the opposite.

Why this tool matters

The value of the FBS AI Assistant is not just in speed, but in how it changes the trading process. Let’s break it down:

1. Speed of analysis

Markets move quickly, and hesitation can cost money. With AI, you get an immediate overview of signals and patterns. That means less time guessing and more time acting.

2. Clarity in the noise

Instead of scrolling through multiple indicators, the Assistant delivers a clean, readable interpretation. It is like having a simplified briefing note rather than a messy spreadsheet.

3. Ideas when you need them

The hardest part of trading is often deciding what to do next. The Assistant provides ready-to-use setups, offering direction when your own analysis stalls.

4. Fewer emotional mistakes

Humans are emotional; algorithms are not. The Assistant keeps the process disciplined, helping you avoid impulsive trades or revenge trading.

5. Institutional-grade tools for everyone

AI analysis was once a luxury of hedge funds and institutional desks. With FBS, retail traders can now use similar tools directly from a smartphone.

It does not replace your thinking, but it amplifies your decision making.

Can this really help you earn?

Convenience is nice, but what most traders really ask is: does this help me make money? No tool can guarantee profits—but the FBS AI Assistant can directly influence the factors that decide whether you end up winning or losing.

Turning consistency into profit: Structured reports force you to trade with discipline rather than on impulse.

Time efficiency: You spend less time analyzing and more time executing.

Protecting against bad trades: Instead of relying only on your gut feeling, you check against an objective algorithm.

Reduced stress: With fewer decisions left to guesswork, the psychological load becomes lighter.

Competitive edge: Most retail traders still trade without AI tools. Using one puts you ahead of the crowd.

The Assistant will not trade for you, but it helps close the gap between beginner intuition and professional structure.

Example use cases

Beginner trader: You are learning and afraid of making mistakes. Instead of staring at charts, you run 5 free reports every day, compare AI’s ideas with your own notes, and slowly build confidence.

Busy professional: You don’t have hours to trade. The Assistant delivers a summary in 10 seconds, so you can decide whether to place an order or skip.

Experienced trader: You already have a strategy, but you use AI reports as a second opinion. If your setup matches AI’s suggestion, conviction increases. If not, you review why.

FAQ: clearing the doubts

“What if AI is wrong?” — That’s why you remain the decision maker. Treat AI as a partner, not a boss.

“Will I get addicted to the tool?” — It is designed to support, not replace you. Using it correctly makes you more independent, not less.

“Only 5 free reports a day?” — Enough for beginners to learn and test. With more funds in your account, the daily quota rises to 15.

“If everyone uses it, won’t signals lose value?” — Edge in trading is not just signals. It’s discipline, timing, and execution. The Assistant helps with those too.

Conclusion

The FBS AI Assistant is not a magic button that prints money. But it is a powerful ally: fast, structured, and accessible. Trading is hard, but with the AI partner it doesn’t have to feel impossible.

Test it in your own trading, and you’ll notice how much easier it feels to stay confident.