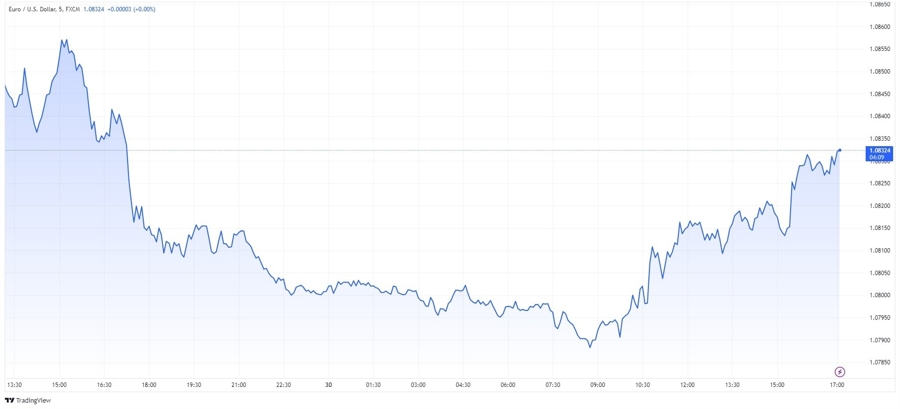

The EUR/USD pair experienced a sharp decline due to an appreciating US dollar. The exchange rate continued its upward trend from Wednesday into Thursday morning, driven by rising bond yields that triggered a flight to safety among currency traders.

Rising bond yields have a significant impact on the dollar. When Treasury yields increase, the dollar becomes more attractive as it is tied to these yields. However, higher yields also raise costs for mortgage payments, corporate debt, and other borrowing in the economy. In summary, while rising yields benefit the US dollar, they can negatively affect economic sentiment and deter investors from riskier assets.

In this environment, the greenback strengthened across the forex market. The EUR/USD pair rebounded after slipping below the crucial support level of 1.08 during Thursday’s European session. Despite cautious market sentiment, the pair recovered as the US dollar corrected.

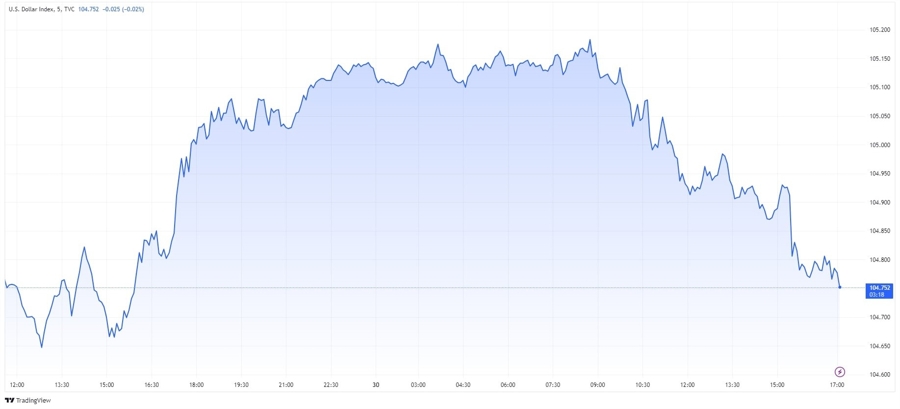

The US Dollar Index declined after reaching a fresh two-week high just above 105.00.

The euro remains linked to the most dovish major central bank according to policy expectations priced into interest rate futures. The European Central Bank (ECB) is expected to implement 69 basis points (bps) in rate cuts this year, compared to only 24 bps anticipated from the Federal Reserve.

This dovish stance has supported the dollar against the euro since January, with the euro falling by over 4.8% through mid-April. However, the euro has rebounded in the past six weeks as traders looked further ahead.

Core inflation in the Eurozone has already declined to 2.7%, and the disinflation process in the service sector has resumed after stalling between November and March. ECB policymakers are comfortable with expectations of the central bank shifting towards policy normalization from June.

With a June rate cut seemingly certain, speculation about the ECB’s rate-cut path beyond June will shape the euro's future movements. Financial markets currently expect one more ECB rate cut this year, although a Reuters poll of 82 economists from May 21 to 28 suggested the possibility of two additional cuts in 2024.

Economically, investors will focus on the May inflation data, which will be released on Friday on both sides of the Atlantic. This data will provide insights into how far and how fast the ECB will lower key borrowing rates.