The Cleveland Fed Inflation Nowcast for December CPI projects a 0.41% headline increase, along with a 0.40% gain for the core.

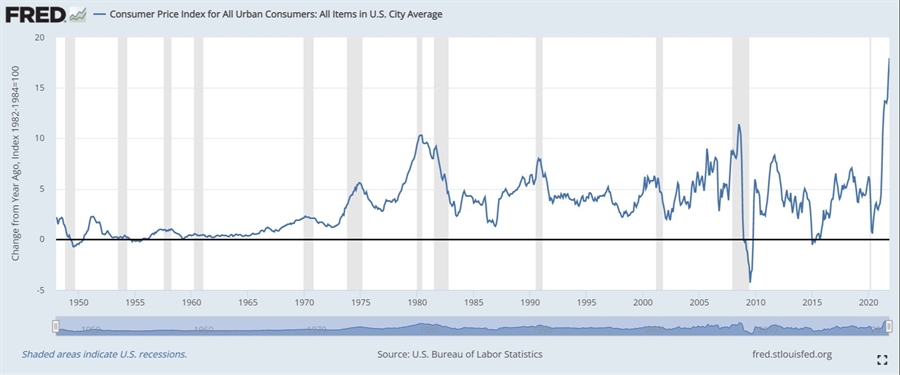

On a y/y basis, Dec CPI is projected at 6.96% y/y, with the core seen at 5.28% y/y versus last month's 1.8%.

The 12M PCE is forecast to rise at a 4.60% y/y rate in December.

The Cleveland Fed says its model has done quite well and in many cases better than alternative models. Such results suggest maybe price pressures are accelerating to the extent some in the Markets currently fear.

Link to Cleveland Fed Inflation Nowcast

Capital flows have clearly supported the bullish narrative but with economic growth weakening and the threat of inflation increasing, the risk of reversal is increasing. As the Fed reduces purchases of Treasuries by $30 billion every month it will no longer be purchasing any new assets by early 2022. This could easily impact sentiment.

Whilst inflation historically has not necessarily been considered a death knell for the Market itself, it would still seem to be a big risk under the current situation as the post-pandemic economic recovery is still in its infancy.

The last thing consumer’s need at this stage is a significant squeeze on real incomes.