New research shows Warren Buffett’s success stemmed from investing in quality businesses with strong intangible moats, not from buying cheap stocks.

The full article is here, a great read:

Warren Buffett Was Never Just a Value Investor. Here’s the Real Secret to His Investing Success

- Data shows Buffett beat markets by investing in quality, not cheap stocks.

but Ive summarised below:

-

Summary:

Buffett’s returns were driven more by quality than cheap valuations

Research shows most outperformance explained by systematic factors

Intangible assets like brands and IP were central to success

Traditional price-to-book value played a smaller role

Buffett anticipated factor-based investing decades early

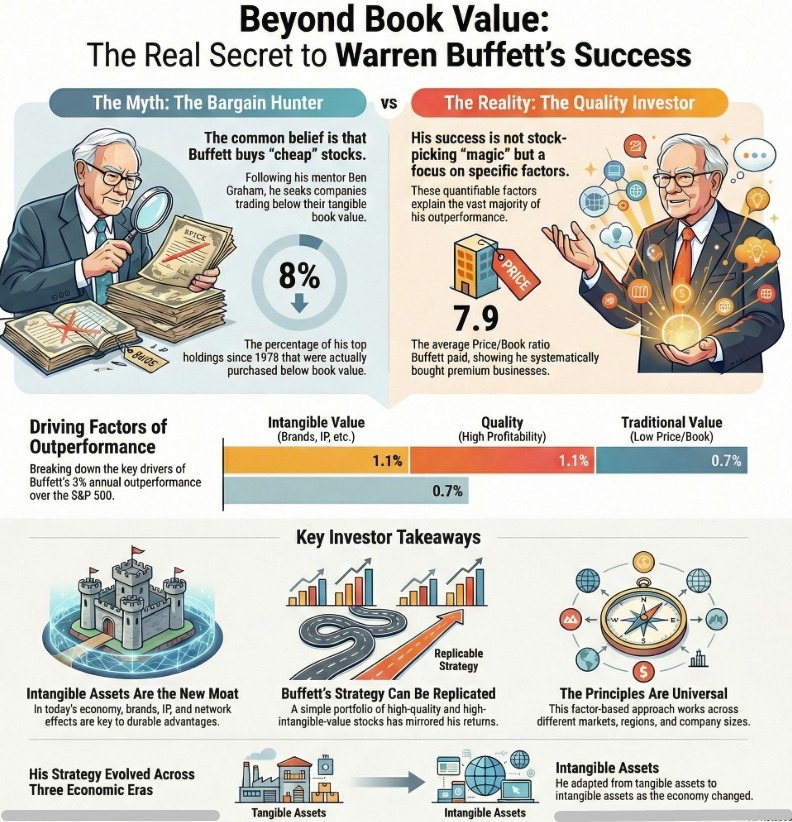

After six decades at the helm of Berkshire Hathaway, Warren Buffett stepped down at the end of 2025, leaving behind one of the most extraordinary track records in financial history. An investment of $100 in Berkshire in 1965 would have grown to roughly $5.5 million, dwarfing the roughly $39,000 generated by the broader US equity market over the same period. While Buffett is often described as a traditional value investor, new research suggests that characterisation misses the real source of his success.

A July 2025 study by Sparkline Capital’s Kai Wu shows that Buffett’s returns were driven far more by exposure to quality businesses with durable competitive advantages than by buying statistically “cheap” stocks. Examining Buffett’s major holdings from 1978 to 2024, the research found that only a small fraction traded below book value at the time of purchase. Instead, Buffett consistently paid premiums for companies with strong brands, pricing power, and long-term growth potential.

This shift reflects Buffett’s evolution alongside the economy itself. In the early part of his career, when tangible assets dominated corporate value, buying below book value made sense. As economies moved toward consumer brands and later technology-driven business models, Buffett adapted. Investments such as Coca-Cola and later Apple were made at valuations far above traditional value metrics, yet delivered exceptional long-term returns as intangible assets such as brand equity, intellectual property and ecosystem dominance compounded over time.

Wu’s analysis decomposed Buffett’s performance using factor-based techniques and found that most of his outperformance can be explained systematically. Exposure to high-quality companies accounted for a large share, while a separate “intangible value” factor — capturing investment in brands, innovation and human capital — explained another significant portion. Traditional value metrics contributed far less than commonly assumed. Once these factors are accounted for, Buffett’s residual stock-picking “alpha” shrinks dramatically, particularly in recent decades.

Rather than diminishing Buffett’s legacy, the findings elevate it. Buffett recognised the rising importance of intangible moats long before they were formalised in academic research and implemented the approach at scale for decades. His real achievement was not mystical stock-picking ability, but the disciplined application of a framework that consistently favoured durable competitive advantages.

For investors today, the implication is powerful. Buffett’s philosophy can be approximated systematically through portfolios tilted toward quality and intangible strength, without needing Berkshire’s scale or individual stock insight. His enduring legacy is not a list of holdings, but a repeatable way of thinking about value in a modern, asset-light economy.