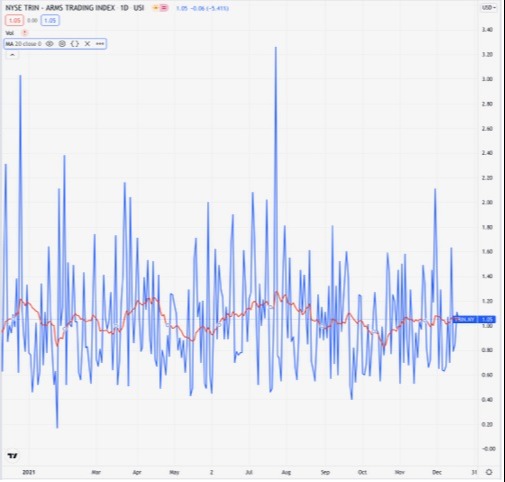

The market breadth indicator ARMS/TRIN index has continued oscillating around the key 1.00 level over recent sessions. A ratio of 1.00 means the market is in balance; above 1.00 indicates that more volume is moving into declining stocks, and below 1.00 indicates that more volume is moving into advancing stocks.

In the current market environment, participants are eagerly looking for signals of overbought and oversold conditions.

With that in mind, it is worth highlighting that the 20-day moving average for the index is currently at 1.05, suggesting that volume continues to flow mostly into falling stocks but is nearing the point of a potential reversal. Is this the makings of the near-term sell-off about to lose some momentum?

Given the current holiday-impacted low volume environment, conditions could change very quickly, so it is worth watching for a decisive move in the ARMS Index, in conjunction with other indicators, for any significant short-term move in the broader market.