Sometimes, you do your work well and even exceed the expectations of your boss and teammates. But such impressive results might not be enough. Seemingly, it’s exactly what happened with Adobe and its stocks. Let’s figure out why the company’s shares drowned after the financial report, and why analysts still look at this asset positively.

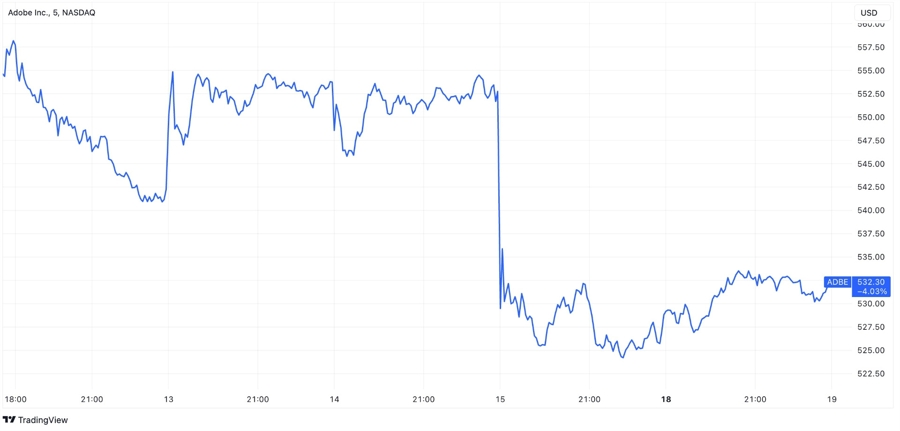

Adobe published the Q3 2023 report, and it beat estimates. But stocks dropped nearly 4% on Friday.

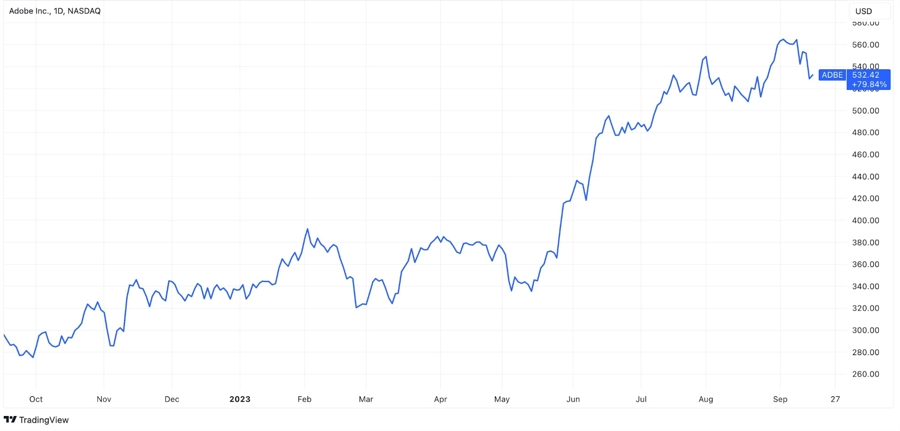

Of course, if you have Adobe stocks in your portfolio, it might be unpleasant. But, actually, most investors envy you. Just look at that — the share price has increased by 80% in the last 12 months. For comparison, Apple stocks have grown only by 15%.

Why did this drop happen? Probably because short-term traders expected too much from Adobe as one of the AI movement enthusiasts. In fact, the report was a little better than estimates. Q3 earnings per share were $4.09 against forecasted $3.98 (+2.81%). Also, the company reached a revenue of $4.89 bln against $4.87 bln (+0.49%). As you can see, these figures were not far from forecasts.

Generally, analysts believe that investors should ignore this decrease. Adobe continues to demonstrate stably high results again and again. This fact allows us to consider the firm’s great long-term perspectives, even after 80% growth last year. Especially in the light of the overall US stocks rally happening recently. And artificial intelligence is a critical point here.

Adobe actively implements AI technologies in its products and services. For example, Adobe Firefly, a generative machine learning model, is already on it. And probably it’s far from the end because AI creates new capabilities for working with images and might help to increase the number of Adobe products in the future, also diversifying them.

Plus, there are not so many competitors for Adobe in this sphere, and it will soon be reflected in subscription prices. All these drivers allow considering stable money flows for Adobe in the following years.

This is probably why the stocks have the analyst rating Buy, and the consensus forecast of +12% in the next 12 months. Of course, it doesn’t mean that you should add these stocks to your portfolio and wait for gains. These forecasts just show that the asset deserves your attention and requires your own analysis, which helps estimate if it’s a good or bad trade idea.