80% of your job is to follow the central banks. They have an enormous influence on financial markets, and I would say they are responsible for most of market moves. A central bank can single handedly trigger or end a recession.

When trying to know how an economy is performing, lots of new traders immediately go to check the economy's indicators like GDP, unemployment, inflation and so on. That’s the wrong way of doing it. You should look for the latest central bank decision and read the statement and economic forecasts.

A central bank has an enormous amount of data and information about its economy. They gather information even from companies, institutional investors and so on.

The central banks will tell you what they are focused on. For example, in the RBNZ (Reserve Bank of New Zealand) August 2025 statement, the central bank said “further data on the speed of New Zealand’s economic recovery will influence the future path of the OCR (Official Cash Rate)”. In the minutes they added “a key judgement for the Committee’s economic assessment was the extent to which spare capacity in the New Zealand economy is likely to persist”.

They were focused on growth, so the GDP data was important for them. In their forecasts, they expected a -0.3% contraction in Q2. When the Q2 GDP report got released, the data showed a much bigger contraction at -0.9%, so there was much more “space capacity” than they forecasted. The market responded immediately by pricing in more aggressive rate cuts from the RBNZ and the New Zealand Dollar sold off across the board.

This is just an example of how knowing what the central bank is focused on and knowing their forecasts can offer incredible trading opportunities. Of course, if the GDP report would have come out much better than expected, the NZD wouldn’t have sold off like that.

It’s not just about reading their statements and forecasts though. Central bank members also give public speeches between their policy meetings, and sometimes they can say something new that changes expectations.

For example, if a central bank member who’s been supporting keeping interest rates steady for months says that current interest rates are fine, it’s not new information. It’s still news, but it’s not “new news”, so it doesn't change expectations. On the other hand, if the central banker suddenly changes his/her mind and starts supporting a rate cut or a rate hike, then that’s new information and the markets will move on that. Markets basically price and reprice expectations.

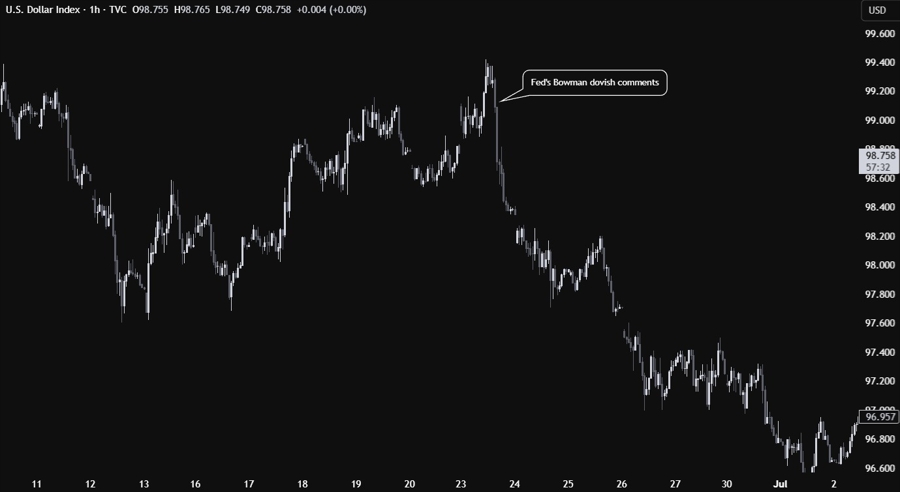

To give you a practical example of this, back in June 2025 we got a change in stance from a Fed governor. Fed’s Bowman has been a hawkish voter for a long time but then she suddenly delivered dovish comments and even opened the door for a rate cut in July. If she had delivered the usual hawkish comments, the market wouldn't have cared because it would have been known information. But she completely changed her stance going from hawkish to dovish.

That new information changed expectations and markets started to price in higher chances of a rate cut in July. Her comments weakened the US dollar for days. Just a few days earlier, we got Fed's Waller delivering dovish comments, but since he's been a known dove for months, his comments weren't as market-moving as Bowman's because it was "old news".

As you can see, central banks impact the FX market in a major way but their influence isn't limited to currencies. They influence interest rates (bond market) which in turn influence growth (stock market) and inflation (commodities). Markets are interconnected and as a BlackRock study found out, 90% of all asset classes returns are driven by growth, inflation and interest rates.

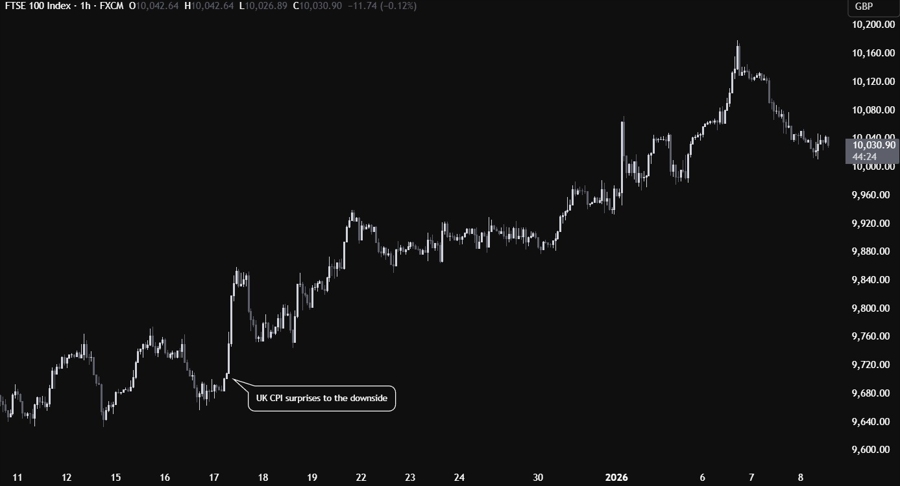

Let's see a recent example with the FTSE 100, the UK stock market index. Last month, the UK CPI report came out much lower than expected. The FTSE 100 rallied strongly following the data release not because of lower inflation per se, but because of the expected change in BoE's (Bank of England) monetary policy.

In fact, traders expected the BoE to sound more dovish and increased the rate cut bets for 2026. A more dovish central bank is generally good for the stock market because it increases economic activity and helps with growth, which is the ultimate driver of companies returns.

That's also how you filter the tradable economic data from the hundreds of reports coming out every month. 90% of the data is meaningless for the market, it's the 10% that can change the next central bank move that matters.