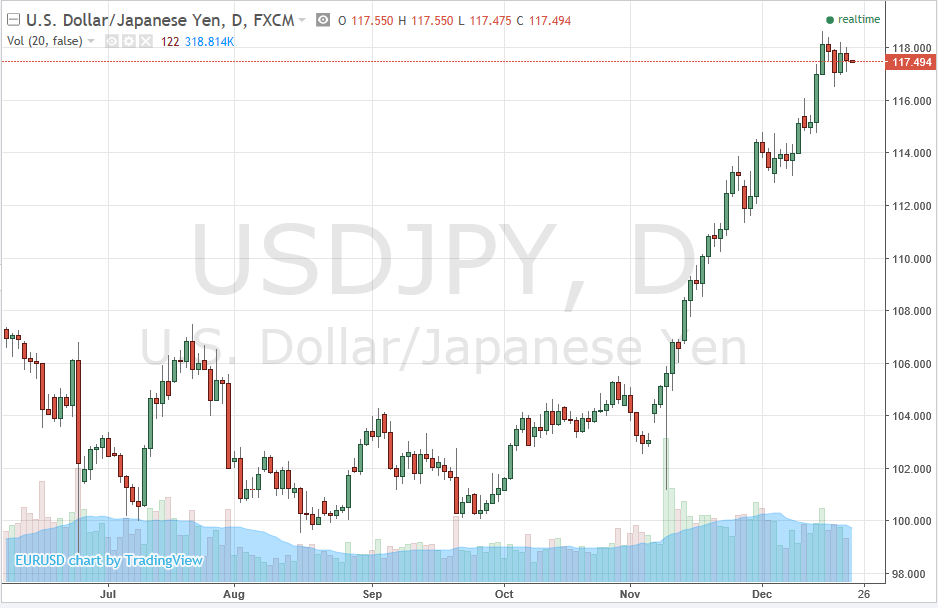

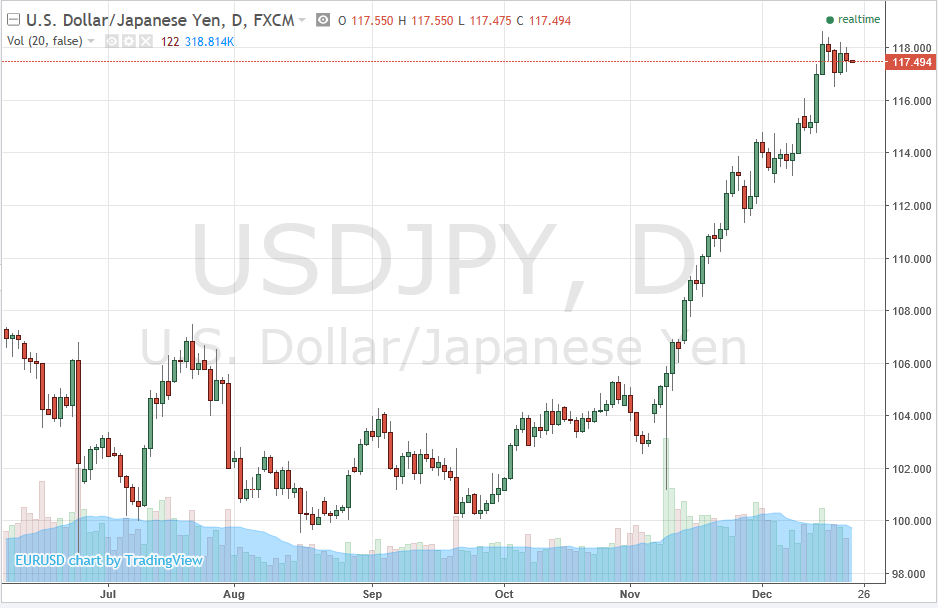

An interesting little item in the Japanese press this morning, particularly if you are new to FX

Its in the Nikkei today, in brief:

- Japanese exporters are snapping up forward exchange contracts to nail down gains from the yen's rapid declines against major currencies in the past month

- Major Japanese companies had assumed rates of 102 yen to the dollar, on average, and around 112 yen to the euro for the second half ending March 2017

- So the yen's sudden plunge has proved an unexpected boon for exporters

Japanese exporters will (in general, not always) receive USD in payment for the exports they sell:

- As Japanese companies they'll need to convert the USD received into yen (to pay rents, workers, Japanese suppliers etc)

- So, Japanese exporters will consistently be sellers of USD/JPY

- When there is a surge in USD/JPY, like we have seen, it is in effect a windfall gain for exporters and there will be a jump in forward selling of USD/JPY to lock in the gain

The article cites some examples; here's one:

- Yokohama Rubber and KYB, a major automobile components maker, decided to increase its forward contracts, hoping to reap more gains from the yen's depreciation

If you're wondering about the impact on importers ....

- the weak yen will increase expenses