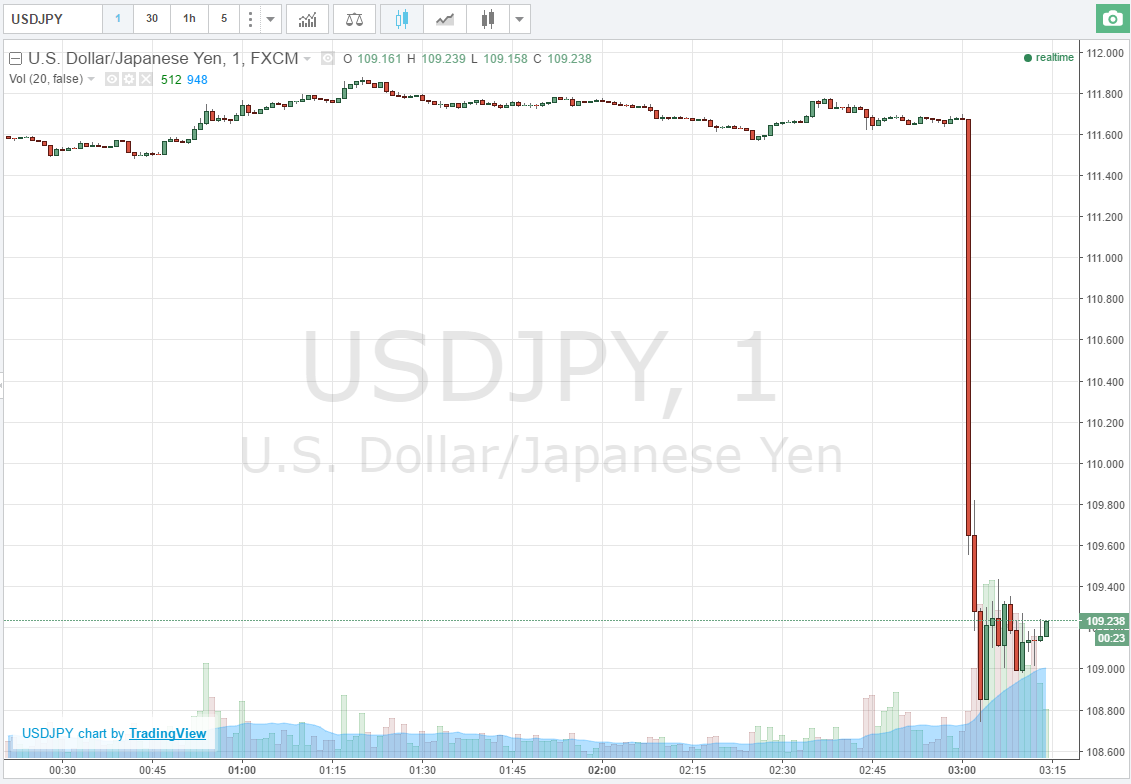

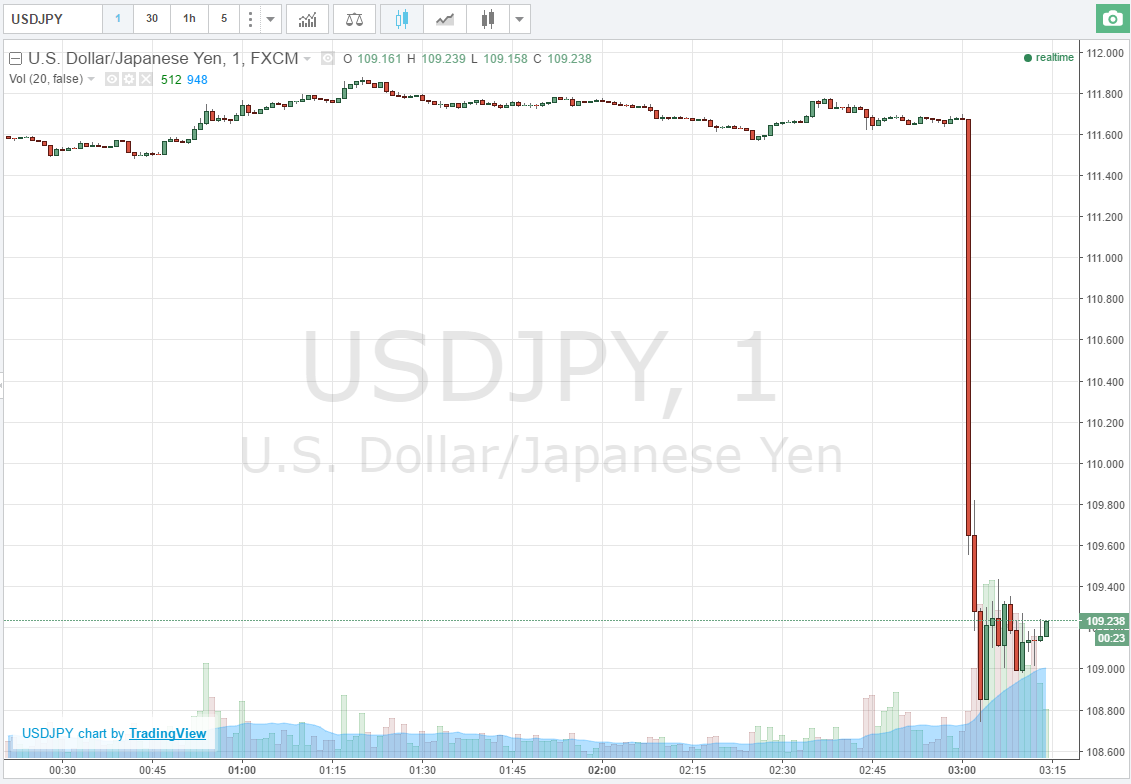

Here's a snapshot I took from the ForexLive chart app in the aftermath of the Bank of Japan decision last week

You may remember the event, the BOJ announced it was leaving policy unchanged and the market response was swift, in fact near instant, the yen surged. Not just against the USD (as shown above) but against crosses too. The move was like a hot knife through butter.

"A hot knife through butter".

That is a metaphor (or perhaps an analogy, or simile, correct me if I have the lingo wrong), a little story about something familiar that's intended to convey a message about something less familiar. In the market, saying something like this is often a useful learning tool, equating something that may be new and misunderstood to something perhaps more familiar, the intention of telling a little story (the hot knife through butter) is well intentioned, to ease learning and increase understanding. (Oh, by the way, if you are hanging about the place heating up knives and passing them through butter, seriously haven't you got anything better to do? :-D )

But, what I'd like to say here is that while using a metaphor can be initially helpful, on balance they are not helpful and can hinder, restrict, or maybe just delay your ability to learn and understand what is really going on. (I should also add, I am as guilty of using them as anyone else.)

So, try not to use metaphors, or to move beyond them quickly and seek understanding. Try to figure our what is really happening in the market. In the case above, its not a hot knife through butter, try instead to understand and appreciate what the move really is. A great way of increasing your understanding is to explain it to someone else (without using a simplifying metaphor).

USD/JPY was priced lower immediately following the BOJ announcement due to a preponderance of sell orders over buy orders. That is self-evident if you know how the FX market works, but its going to get you closer to understanding the move than a metaphor for the move will.

Expectations were high for the BOJ to act further, and many in the market were positioned accordingly; when the expectations were dashed (is that a metaphor? I told you I was guilty) USD/JPY longs rushed to get out, trying to play 'hot potato' (metaphor again) and 'pass the parcel' (ditto) - i.e. a large number of sellers trying to sell to a small number of buyers - hence a price 'gap' lower. Those readers who have taken Greg's ACT (Attacking Currency Trends) Course may recognise some of what I am saying from there.

When you hear, or are tempted to us, a metaphor, by all means go ahead. But maybe also spare a moment to break it down and think through what is really going on in the market. If you don't know, or are unfamiliar with how the market works (especially the forex market), do the work to try to understand, ask the questions.

The market environment is an environment unlike much of what most people are familiar with, and equating market phenomenon to scenes we are more familiar with often obscures understanding.

(Apologies for the weekend rant - have a good one! :-D )