We had some discussion on Friday and further over the weekend with regards to technical analysis and whether it works or is useful.

Adam got a fairly tepid reaction to The technical analysis story in EUR/USD couldn’t be any simpler Friday, while Eamonn’s post, Does technical analysis work, or should it be in the same category as astrology and voodoo? garnered a more mixed response.

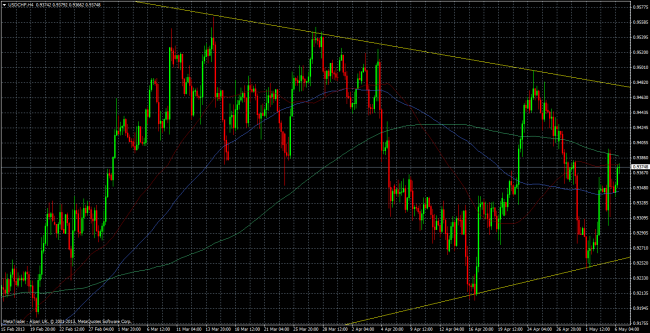

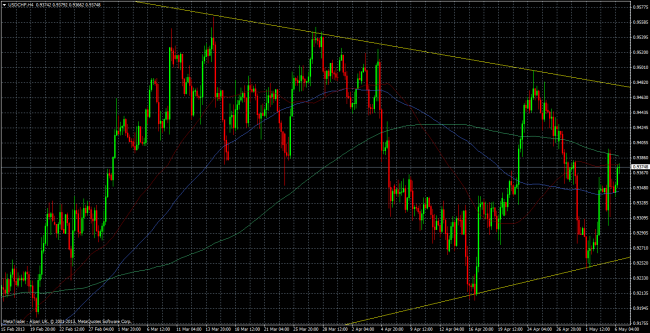

Well USD/CHF is proving to be a tech cash machine.

I’ve spoken about the pair a few times previously

Even before my posts the pair has been playing nicely within the tech.

Now I’m not trying to blow my own trumpet by pointing out my earlier posts but just using it to push the case for TA. The downer is that for one reason or another I didn’t trade the tech anyway, so I’ve got the right hump with that.

The picture is perfect for what can be achieved when tech works.

Now I’m sure I’ll get the argument that the same tech doesn’t always work, but it’s never ever just about the tech. It’s about using it to help define boundaries and giving an enhanced chance of turning a profit.

It’s easy to draw comparisons to trading FX with poker, whereby the good players calculate their risk and reward. The principle though is equally applicable to forex trading.

A wise man and trader once told me “Good traders make money. Great traders know how not to lose money”

That saying is very true and it’s a principle I use when trading. My thought process before entering a trade is what can go wrong not what can go right. It doesn’t mean I never lose, far from it, but it mostly means I don’t lose a lot and that is one big factor you need in trading.