Trading MACD and levels

This strategy combines pragmatic elements of price action analysis and the statistics of trading indicators, without which it might be hard to make a decision, no matter how traders may dislike them. For trading the MACD and levels, choose H4 and longer timeframes, Forex, futures, or stock markets.

A signal to buy in trading the MACD and levels

The strategy is quite "capricious", requiring special conditions on the chart for a signal to buy to appear:

- The chart must boast the opportunity to draw three S/R levels; the price must stay between the two upper ones.

- The last highs and lows must be higher than those right before them.

- After the last bounce off one of the three mentioned levels, the MACD values must also be above its signal line.

- The distance between the two lower S/R levels must be either smaller than between the middle and the upper ones or just a tiny bit larger.

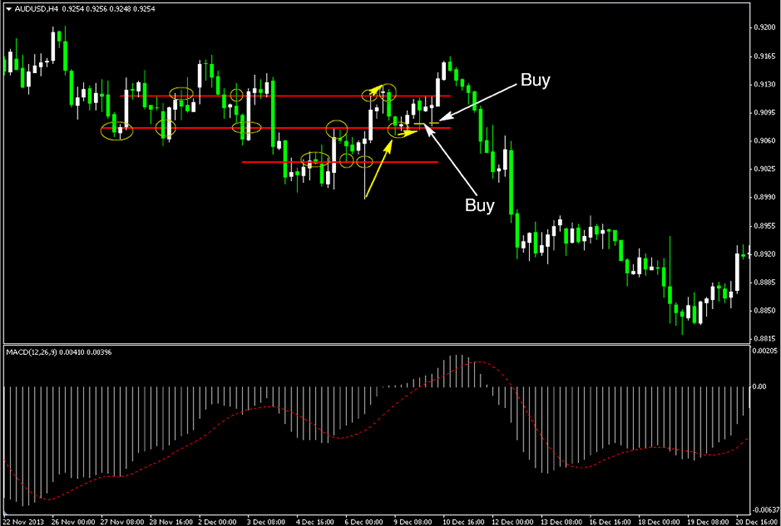

If all the requirements are fulfilled, place a Buy Limit order plus a spread several ticks above the middle one of the three levels. If on one formed candlestick the MACD indicator value becomes less than its signal line, delete the order. Examples of signals to buy by the strategy with the MACD and levels:

In the picture, you can see two signals to buy in a row: note that the first one has not violated the rules enumerated above as its local low was higher than the previous one - and thus it reinforced the base for the second signal.

As for the condition of increasing highs and lows, I suppose, it helps to define the trend on the signal part of the chart; remember that playing counter the trend is always harder than along with it.

A signal to sell in trading the MACD and levels

Here, the situation must fulfill the following conditions:

- There must be an opportunity to draw three support and resistance lines on the chart, and the price must stay between the two lower ones.

- The last local high and low must be decreasing compared to the high and low directly preceding them.

- Since the last bounce off one of the three levels, the MACD value must remain under its signal line.

- The distance between the upper and the middle lines must be smaller or just a little bit bigger than between the lower and the middle levels.

If all the requirements are met, place a Sell Limit several ticks lower he middle level. An example of a signal to sell for trading by the MACD and levels:

Stop Loss and Take Profit in trading by the MACD and levels

In case of buying, place a Stop Loss several ticks below the lowest level because nothing protects an SL better than one more level. If you trade short using the MACD and S/R levels, place an SL above the uppermost level plus several ticks plus a spread.

As long as normally the distance between the TP and entry point is short, transferring the trade to the breakeven when trading by the MACD and levels seems unlikely because otherwise, trades will be closing too often.

Following positions when trading by the MACD and levels also seems hard due to narrow price channels; however, if you manage to find a way to increase the mathematical expectation of trading, go ahead.

Money management for Forex, futures, and stock markets

As long as trading the MACD and levels requires the use of pending orders, feel free to calculate the risk in percent of your deposit. Think twice before increasing the risk by more than 1-2% of the deposit because if you aim higher, your future as a forex trader will be seriously compromised.

Of course, you can operate a certain lot size, however, possible tick risks are not low enough for it to be legitimate.

An example of trading by the MACD and levels

At first sight, it may seem that trading by the MACD and levels is not so attractive in terms of the profit-to-loss ratio. However, the pre-trade probability (as I call it) to succeed with a trade is rather high thanks to well-matched trading conditions.

This article was submitted by Dmitriy Gurkovskiy, Financial Expert and Author at RoboForex Blog