Reading the strategies of big banks can help your trading

We like to post bank trades, recommendations, analysis etc as it gives some perspective on what the big boys are looking at. Some laugh, some use them as counter trade triggers and there is a morbid interest in seeing the big guns take a hit.

Now, I should make it clear I don’t take any real pleasure in seeing anyones positions get blown up, and I’m certainly not holding a ‘holier than thou’ attitude towards bank calls. It’s hard enough trading my own book let alone passing judgement on others but my main gripe with these calls is where they get their levels from.

I can understand the reasoning, even if I don’t agree with it but to me I sometimes can’t see where they get their number from. It may be a lack of info reported but either way it gets me scratching my head and it’s also something inexperienced traders should look to learn from. Don’t just mark these calls as crap and reverse indicators, explore why they may be right or wrong and look for what you would do in the same situation. Use these trades to learn.

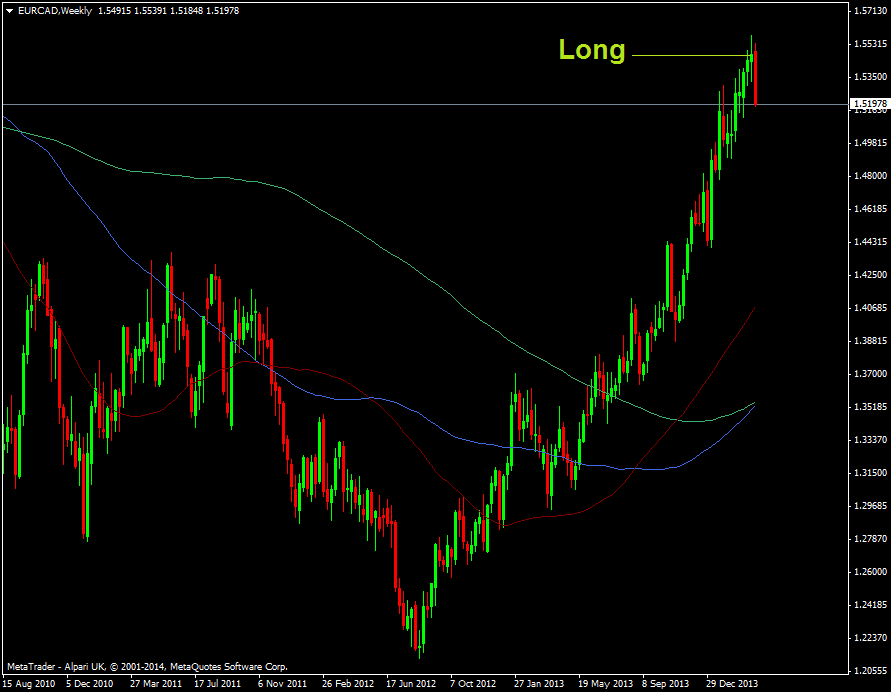

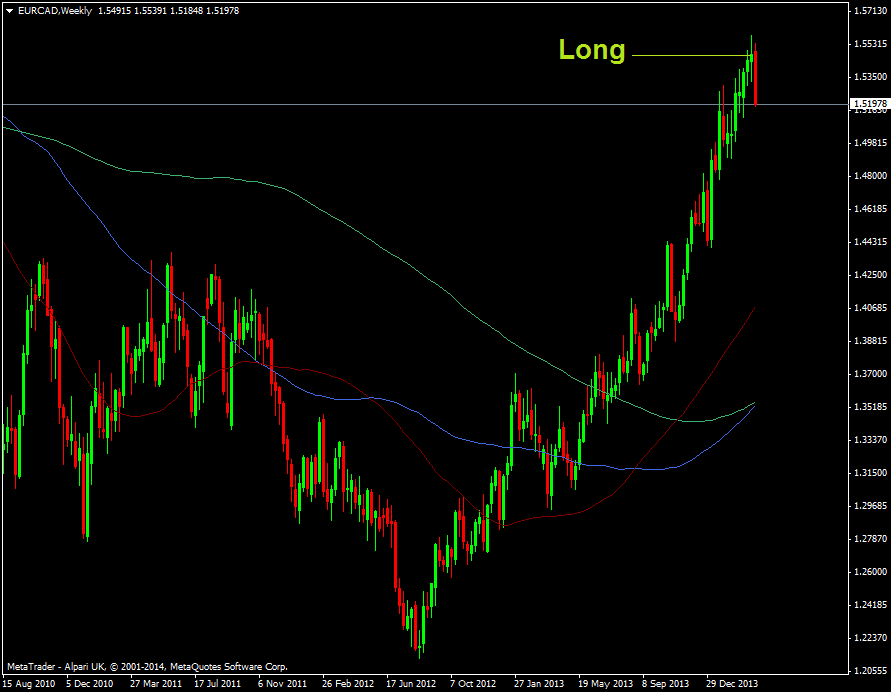

Take this Morgan Stanley long EUR/CAD call. Would you have bought in 140 pips off the top of a near 2 year uptrend?

EUR/CAD weekly chart 27 03 2014

Asking questions is the first thing anyone should do before entering a trade. These questions should be applied to our own trading everytime;

- What do I see?

- What’s my reasoning?

- What could go wrong?

If you can get a positive answer from all three then you’re halfway there. If you have indecision in any one of those questions then it’s better left alone or you adjust your trade until you can. The key thing though is to be honest with yourself when answering and keep asking those questions even after you’ve put the trade on.

For the EUR/CAD trade, I would not be buying up there but would wait for decent pull back or a break of a higher level to run with. The tech would play its part also in picking entry and exit points. In this trade I don’t see what Morgan Stanley sees so wouldn’t touch it with a barge pole.

If you trade without asking questions then you’re doing no more than throwing a dart at the dartboard with a blindfold on and that’s not going to do you or your account any good whatsoever.

Again, for balance and fairness look at the chart and give me what you would do? While I’ve given my view I’m still very much open to learning something different, and you should be too.