Today’s durable goods orders report is a great example of what really matters in economic data.

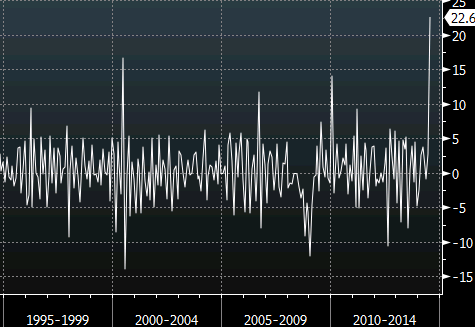

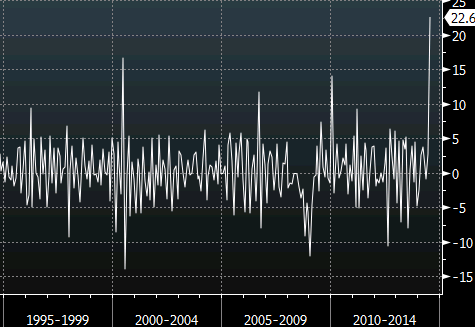

July orders rose 22.6%, the highest ever and blowing away the previous record of 16.6% but the market hardly moved and then the US dollar slipped. Why?

Durable goods orders

Orders were goosed by a record number of contracts Boeing signed at the Farnborough Airshow. That’s good news for Boeing but those planes won’t even begin production for 4-5 years. And it’s guaranteed that Boeing won’t be able to sustain that level of orders so next month’s headline orders are likely to be the lowest on record.

The market focuses on data that strips out aircraft orders and equally volatile defense orders. That’s a better signal on the underlying strength in the economy. That metric fell 0.5% compared to +0.2% expected. Yet even that isn’t a clear metric because the prior reading was revised up to 5.4% from 3.3%.

FOREX TRADING TIP: Sometimes fundamental data is not what it appears to be. Durable Goods Orders, with the volatile aircraft orders is a release which can be distorted. Knowing the details behind the numbers, can save you from trading when you should be more cautious.