Summary:

Tom Lee says Bitcoin has not yet peaked

New all-time highs possible as early as January

2026 seen as volatile first half, stronger second half

Ethereum described as undervalued entering a supercycle

S&P 500 forecast to reach 7,700 by end-2026

Bitcoin has not yet reached its cycle peak and could print a new all-time high as soon as this month, according to Fundstrat Global Advisors co-founder Tom Lee, who reiterated his bullish stance on digital assets and equities during an appearance on CNBC Squawk Box.

Lee said recent weakness across crypto markets should not be interpreted as a definitive top. While he acknowledged that earlier expectations for a late-2025 breakout proved premature, he argued that price action remains consistent with a broader uptrend. In his view, investors should not assume that Bitcoin, Ethereum or the wider digital-asset complex has already peaked.

The comments follow a sharp pullback into year-end 2025, with Bitcoin retreating from an October record above $126,000 to around $88,500 by December 31, according to CoinDesk. Lee positioned January as a potential inflection point, describing the correction as part of a broader consolidation phase after several years of outsized gains.

Looking ahead, Lee characterised 2026 as a “two-speed” year for crypto markets. He expects the first half to be volatile, driven by institutional portfolio rebalancing and what he described as a strategic reset across risk assets. That process, however, is not seen as a sign of structural weakness. Instead, Lee argued that such periods of turbulence historically lay the groundwork for stronger advances later in the cycle, with a more powerful rally emerging in the second half of the year.

Lee was particularly constructive on Ethereum, describing it as significantly undervalued and entering a multi-year expansion phase similar to Bitcoin’s 2017–2021 cycle. Despite missing earlier price targets, he has reinforced that view through balance-sheet positioning. His crypto-focused firm, Bitmine Immersion Technologies, has continued to accumulate ether, framing exposure as a strategic treasury decision rather than a speculative trade.

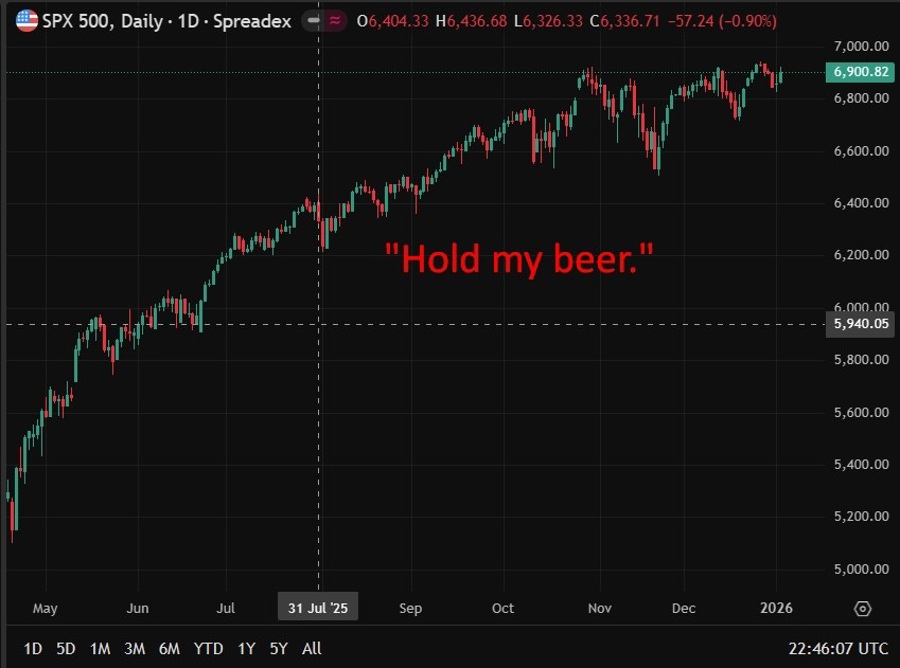

Beyond digital assets, Lee extended his bullish outlook to equities. He forecast the S&P 500 could climb to 7,700 by the end of 2026, citing resilient corporate earnings and productivity gains driven by artificial intelligence. Any near-term pullbacks, he said, should be viewed as opportunities rather than warnings.