Ethereum Technical Analysis with tradeCompass for Today (September 23, 2025)

Bullish above: $4200

Bearish below: $4173

Current Price: $4199

Primary Bias: Neutral until one side confirms

Partial Targets: $4208.5, $4231.5, $4287.5, $4497.5 (bullish) | $4144.5, $4120, $4065, $3970 (bearish)

Ethereum Market Context and Directional Bias

Ethereum futures trade at $4188, in the middle of the range between the bullish threshold at $4200 and the bearish threshold at $4173. A sustained move above $4200 could open the door to a bullish sequence, while a drop below $4173 activates the bearish playbook.

What qualifies as “sustained” depends on your style: some traders wait for 15 minutes above the threshold, others rely on secondary indicators, and some act on the first tick beyond the line. tradeCompass provides the map, and you choose the trigger.

Until one side is activated, Ethereum remains neutral inside the $4173–$4200 range.

Ethereum Market Backdrop: Declining Volume and What It Might Mean

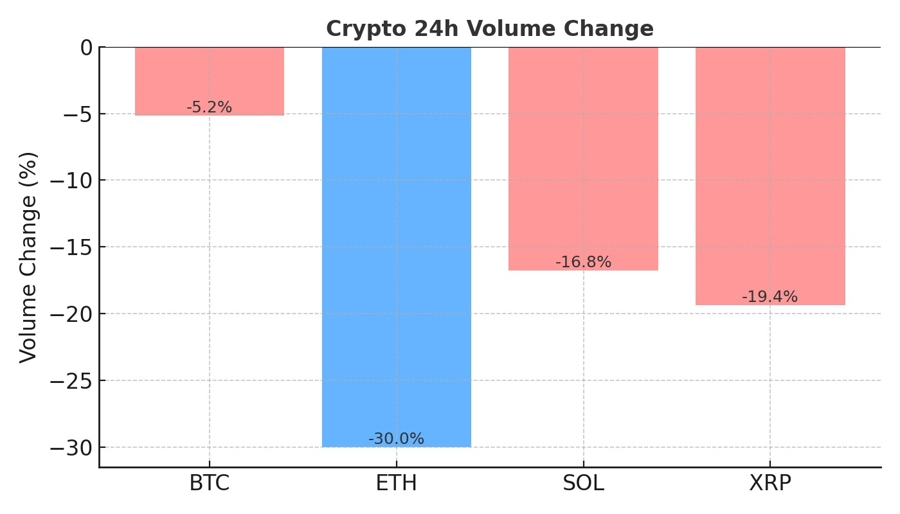

Over the last 24 hours, Ethereum is nearly flat (+0.10%) but trading volumes have fallen sharply by ~30%. This follows two days of declines and a small rebound attempt.

A drop in trading activity after heavy selling can sometimes indicate that bearish pressure is cooling—panic-driven selling may have run its course, leaving room for stabilization. However, lower volume can also reflect apathy rather than new buying strength. That’s why the tradeCompass thresholds remain critical: confirmation above $4200 or below $4173 will tell us if the next directional wave is ready.

Today’s Ethereum Futures Key Levels and Partial-Profit Strategy

Bullish Trade Plan (above $4200)

First target: $4208.5, just under yesterday’s VWAP. Quick exit to manage risk.

Second target: $4231.5, near today’s high. By default, move stops to breakeven here.

Third target: $4287.5, linked to September 9th’s Value Area Low and prior liquidity.

Final swing target: $4497.5, just under the $4500 psychological barrier.

Bearish Trade Plan (below $4173)

First target: $4144.5, just above yesterday’s Point of Control. Move stop to breakeven here.

Second target: $4120, near today’s third lower VWAP deviation.

Third target: $4065, further downside objective.

Extended target: $3970, beneath yesterday’s low, for those seeking continuation.

Educational Corner: Entry Confirmation and Flexibility

The idea of a “sustained break” can be applied in different ways. Some traders demand multiple candle closes beyond a threshold, while others prefer immediate engagement. Both can work. The key is consistency—decide on your method and apply it systematically. tradeCompass is meant as a flexible framework to integrate with your own playbook.

Trade Management Reminders

One trade per direction per tradeCompass.

After TP2, stops move to breakeven to lock in gains and manage the runner.

Place stops with a small buffer beyond your entry-side threshold—never past the opposite threshold, as that invalidates the setup.

Use confirmation methods that match your risk style.

Ethereum Technical Analysis Conclusion

Ethereum is hovering right at the line between bullish and bearish setups. The steep volume decline hints that sellers may be losing steam after recent declines, but confirmation is everything—$4200 for bulls, $4173 for bears. Until one side breaks, patience is the best position.

tradeCompass Methodology Principles

Defines daily bullish/bearish thresholds.

Encourages partial profit-taking at logical levels like VWAP, POC, VAH/VAL, or round numbers.

Promotes disciplined stop placement linked to thresholds.

Designed to support different trading styles and timeframes.

One trade per direction keeps risk controlled.

Disclaimer: This Ethereum technical analysis is for educational and decision-support purposes only. It is not financial advice. Trading involves risk, and outcomes are never guaranteed. Always trade responsibly. Visit investingLive.com, formerly ForexLive.com, for additional views.