Crypto is red today but tradeCompass is open to both sides, depending on how price is located in relation to the bullish or bearish tresholds.

Bullish above: $114,050

Bearish below: $113,485

Current price: $112,810

Primary Bias: Bearish while under $113,485

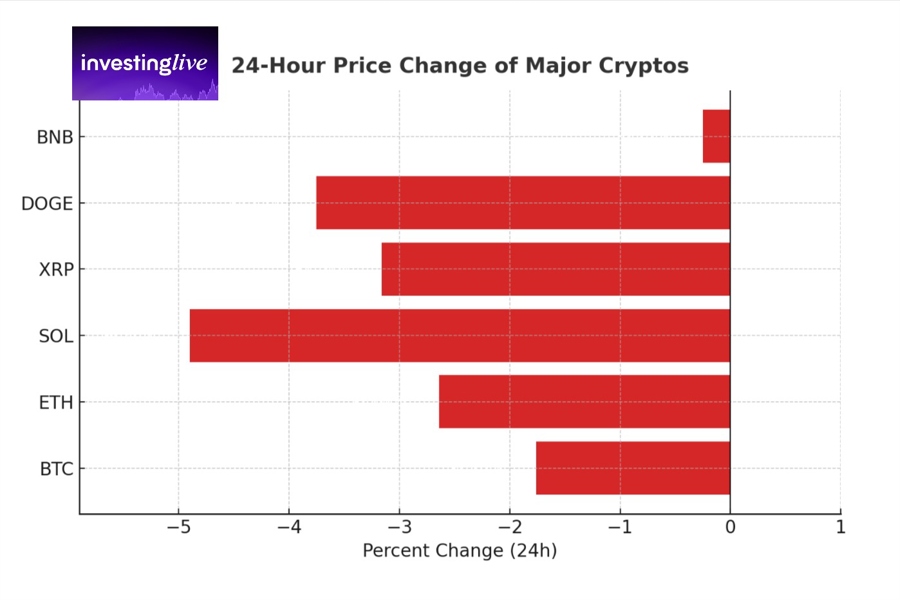

Market Backdrop: Bitcoin and Majors in the Past 24 Hours

The last 24 hours have been broadly negative across crypto markets. Bitcoin slipped ~1.8%, Ethereum dropped ~2.6%, and high-beta names underperformed: Solana fell ~4.9%, Cardano lagged, XRP lost ~3.2%, and DOGE ~3.8%. The relative outlier was BNB, which held almost flat (-0.25%), showing resilience compared to peers.

The decline was orderly rather than panicked—no sign of capitulation. Altcoins with higher risk profiles bled harder, a classic risk-off signal. Traders will want to see Bitcoin and Ethereum begin to form higher lows with lighter selling pressure before treating this as anything other than a fade-the-bounce tape.

Bitcoin Technical Analysis: Directional Bias

At the time of this analysis, Bitcoin futures trade at $112,810, directly on today’s Point of Control (POC). With the bearish threshold set at $113,485, price is currently in bearish territory.

That said, intraday retracements back toward $113,400–$113,600 are possible. Some traders may prefer to short closer to that zone for a cleaner entry, while others might scale in—placing a partial short here and saving the bulk of their position for any retrace closer to the threshold.

Bitcoin Analysis for Today: Key Futures Levels and Partial Profit Targets

For bearish setups (shorts):

First partial target: $112,875, just above today’s POC, where market flow often slows.

Second target: $112,435, overlapping with liquidity pools from September 7–10.

Third target: $111,680, matching the September 9 POC.

Final target: $111,050, in line with the September 9 VAL and liquidity from September 4–5.

For bullish setups (longs):

Activation level: $114,050.

First target: $114,330.

Second target: $114,745.

Third target: $115,560.

Final target: $116,000, a potential magnet if buying momentum takes hold.

Educational Corner: POC and Why It Matters in Bitcoin Futures

The Point of Control (POC) highlights the price where the largest trading volume accumulated during the session. It often acts as a market balance line—prices revisit it frequently, and it tends to serve as both support/resistance and a profit-taking magnet. For Bitcoin futures technical analysis, the POC is a vital guidepost because it shows where traders found the most “fair value” during the day.

Trade Management Principles for Bitcoin Technical Analysis

One trade per direction under tradeCompass to avoid overtrading.

After reaching TP2, shift the stop to entry (breakeven) to protect gains and manage the runner.

Stops belong just beyond the entry-side threshold with a small buffer—never beyond the opposite threshold, as that invalidates the trade setup.

Confirmation can be flexible: some traders wait for closes above/below thresholds, others use VWAP retests or intraday higher lows for timing.

Professional Reminder

This Bitcoin analysis for today is designed as a decision support framework. It does not guarantee outcomes and is not financial advice. Futures and crypto markets are volatile, and risk management is essential. Always size positions responsibly. Visit investingLive.com (foremerly ForexLive.com) for additional views.