Bitcoin is currently trading down -$5333 or -5.91% at $85,024. The low price reached $83,814. Recall that on November 21, the cycle low off of its all-time high from October 6 of $126,272 reached $80,537.

Strategy (formally MicroStrategy) is a catalyst for the decline..

The company sharply cut its financial outlook and sold shares to build a $1.44 billion cash reserve as falling Bitcoin prices pressure its results. The company now expects full-year earnings to range from a $5.5 billion loss to a $6.3 billion profit—or –$17 to +$19 per share—a major downgrade from its prior forecast of a $24 billion profit ($80 per share). The stock is currently trading at $159.12 down $18 or -10.27%. The price is down -45.10% for the year.

The revised guidance reflects Bitcoin’s steep decline to $84K, well below the $150,000 year-end level used in its earlier forecast.

Strategy holds 650,000 bitcoins (worth about $54.8 billion at current prices) and created the new reserve to ensure coverage of 12 months of preferred dividends and debt-interest payments, with a plan to extend coverage to 24 months. Executive Chairman Michael Saylor said this buffer will help the company manage near-term volatility.

The preferred shares have been under pressure lately on fears that the company would not be able to fund the preferred dividends (and other interest payments) without selling bitcoin. The company's strategy has been to issue common stock, preferred stock, and convertible debt to fund purchases of bitcoin. All is fine well until the punch bowl gets taken away due to the price bitcoin moving sharply lower. That is what has been happening.

Admittedly, the company does still hold 650,000 of bitcoin valued at $54.84 billion. The hope was that the share issuance and the cash reserve for dividend would call off the dogs.

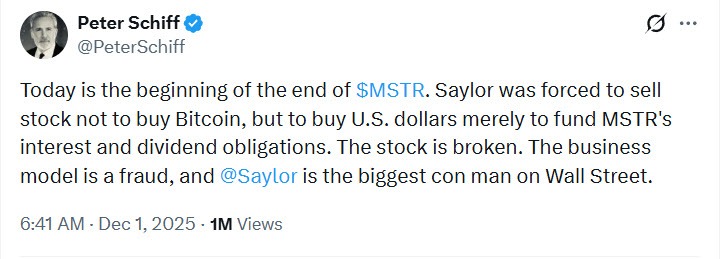

Peter Schiff is not impressed. He posted on X

Today's action was thought to take some of the pressure off of the stock and in turn bitcoin, but it has not. There tends to be those market plays where the sharks smell blood and take on a the "player". Is this an instance?

Technically, the price of bitcoin is back below the 50% midpoint of the move up from the August low at $87,925. The price remains above the low price from October and the 61.8% retracement at $78,874. There is also support between $72,010 and $74,588 (see red numbered circles on the chart below).

For MSTR it is trading above its low at $155.56, but is still down over 10% on the day. At session lows the price tested a trendline connecting lows from May and September 2024.That is the only positive from the stock chart below as it melts from it's all time high price of $543 reached in November 2024. Nevertheless, if the level holds, the buyers against the level can get on their knee's and hope for a bounce.

Strategy announced its latest Bitcoin purchase just this morning, December 1, 2025.

Here are the details of the most recent buy:

Buying Period: Between November 17 and November 30, 2025.

Amount Purchased: 130 BTC

Total Cost: Approximately $11.7 million

Average Price: ~$89,960 per Bitcoin

Context: A Shift in Strategy?

This purchase was notably smaller than their typical buy (often in the thousands of BTC). HMMMM

Total Current Holdings: As of today, the company holds a total of 650,000 BTC, acquired at an average price of roughly $74,436. With the low for the year around $80,000, that is close to giving all the gains away. Of course the mantra is HODLwhich is slang for "Holding on". It also can mean Hold On for Dear Life.