If you think that bitcoin is the canary in the risk appetite coal mine, then there's a problem. There is a strong correlation between bitcoin and the Nasdaq, with chipmakers particularly levered.

Lately, there has been a disconnect but it could just been bitcoin leading. Part of the thinking on the bitcoin correlation is that it's more of a pure play on speculation and animal spirits. Again, if that's breaking down then it's not good for the massive amount of leverage in the system.

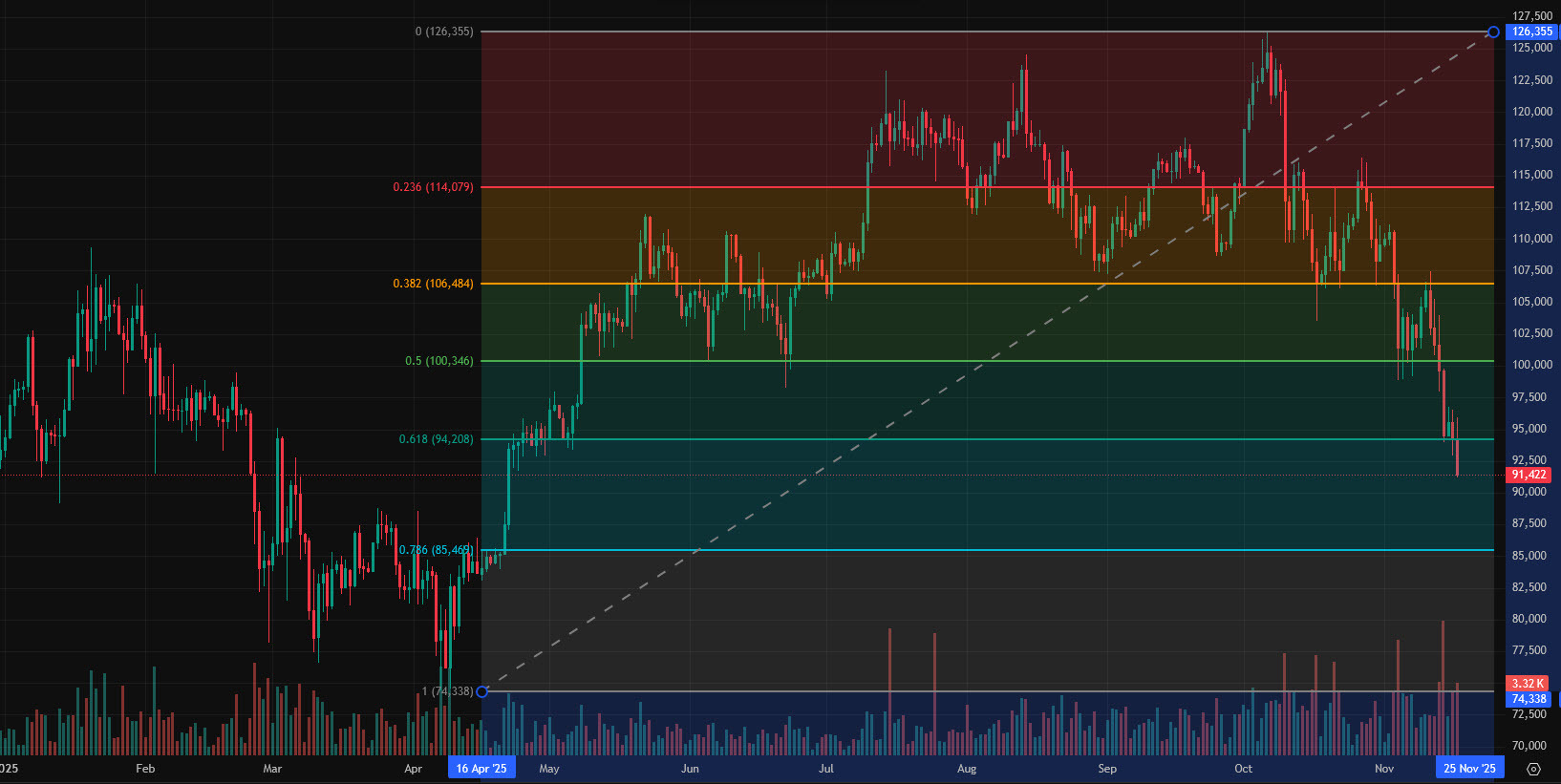

Bitcoin is now down 25% from its high in October. There is also a death cross with the 50-day moving average falling below the 200-day. Finally, this clears the 61.8% retracement of the rally since Liberation Day. The low then was near $74,000.

Bitcoin daily