Bitcoin Futures Technical Analysis – Trade Compass for June 26, 2025

Current Price: $108,590

Daily Change: +0.07%

Bias: Bullish (while price remains above $108,440)

This update is a quick but valuable one, requested by a trusted member of our trading community (nicknamed “Crypto”). If this analysis helps you lock in profits today — thank him later. Now let’s jump right into it.

🎯 Bullish Trade Plan for Bitcoin Futures Today

Active above: $108,440 (Today’s VWAP)

Price is already trading above our bullish threshold, reinforcing the bullish bias.

Partial Profit Targets for Bulls:

$108,825 – Yesterday’s Value Area High

$109,050 – Just under the 2nd Upper VWAP Deviation (Today + Yesterday)

$109,625 – Technically significant resistance

$110,830 – Just below the Point of Control from June 11

$111,130 – Just under the Value Area High of June 11

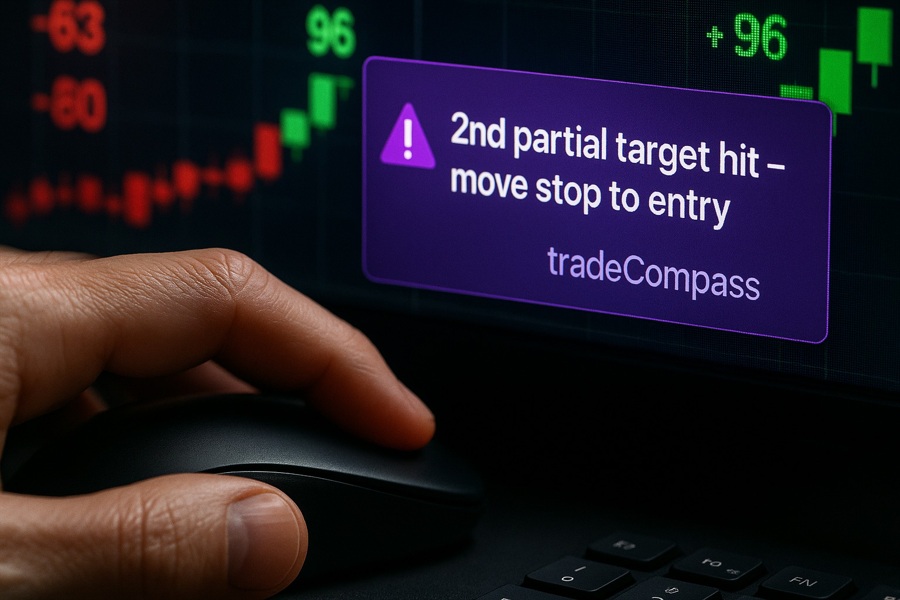

⚠️ If the second partial profit target is reached, consider moving your stop to breakeven on the rest of your position.

🔻 Bearish Trade Plan for Bitcoin Futures Today

Active below: $108,040

(This is beneath yesterday’s HVN, today’s Value Area Low, and the start of today’s VWAP)

Partial Profit Targets for Bears:

$107,810 – In line with the 2nd Lower VWAP Deviation (Today)

$107,420 – Just above June 20’s VWAP

$106,870 – Just above the June 20 POC and June 17 VAH

$105,890 – June 24 Value Area Low (Runner Target)

✅ Bears who reach the second partial profit target should consider moving their stop to the entry point.

🧭 Why tradeCompass Helps

The Trade Compass isn’t just about direction — it’s about strategy.

It helps you:

Identify realistic profit zones based on where other participants are likely to act.

Scale out properly to secure profits without guessing.

Manage risk, including when to move your stop to breakeven.

🛑 Trade at your own risk. This is not financial advice.

Stay tuned for more insights — and don’t miss today’s NASDAQ tradeCompass if you’re active across markets.