Central Banks

Central Banks

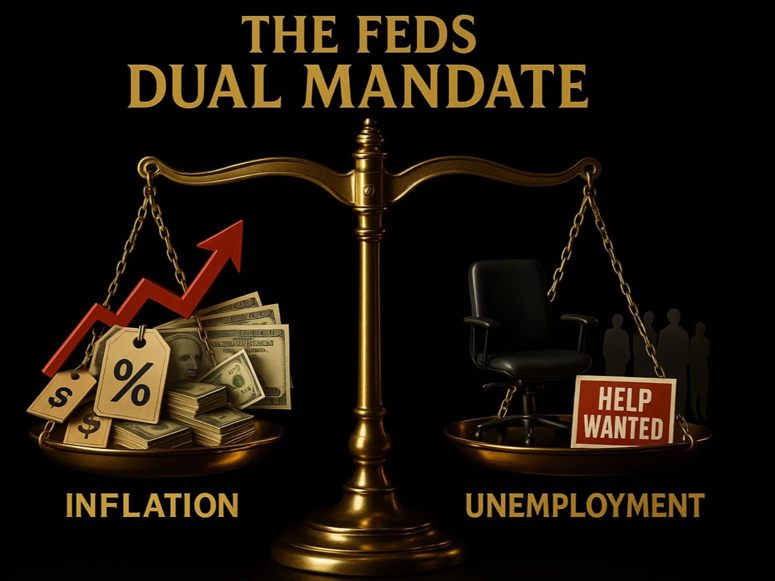

Fed's Hammack: Fed policy should stay modestly restrictive to lower inflation

- Hawkish talk from Hammack

Fed's Barr: Progress has been made on inflation, but there is still work to do

- Fed's Barr is speaking

Fed Williams: The natural rate of interest is hard to pin down

- Fed's Williams is on the newswires.

Building a Winning Trading Strategy from Scratch

- The road is not glamorous, but it is logical.

How Professional Traders Learn and Refine Their Skills

- Professional traders don’t merely accept uncertainty; they court it.

ECB's de Guindos: Inflation news is positive

- Comments from the ECB Vice President, Luis de Guindos

FBS Analysis Shows Ethereum Positioning as Wall Street’s Base Layer

- Ethereum’s transformation is being accelerated by its staking economy

PrimeXBT Wins Global Forex Award for Best Multi-Asset Trading Platform

- The award reflects an ongoing commitment to supporting traders and raising industry standards.

Virtual Pay Group Secures Visa Principal Acquirer License

- The Visa Principal Acquirer license grants Virtual Pay greater operational independence and scalability.

Fed rate cuts in 2026 priced out as traders bet on hold. 10-yr yields dip to 4.15%. Inflation worries persist.

84% of wealthy near-retirees ditch target-date funds for custom strategies; average investors may miss tax optimization.

Inflation bites essentials: groceries +7% elec, gas double-digit. K-shaped economy widens divide. Fed holds rates.

Orsted shares jump 10% as US court lifts Trump block on offshore wind. Revolution Wind project resumes, defying 'loser' claims.

Trans-Pacific container rates jump 5-7% as U.S. retailers restock; NRF sees 6% Jan volume rise, but annual deficits persist.

Retail piles into memory chips: SanDisk +65% YTD, WDC & Seagate see big inflows. AI demand fuels supply fears, lifting valuations.

US MBA Mortgage Applications for the week ending January 9 increase to +28.5% vs +0.3% prior

Must Read