XM Group

- Minimum Deposit 0-50

- Leverage 1000:1

- Regulation FSC, DFSA, CySec, FSCA

XM Broker Review 2025: Platforms, Fees, Regulation, and More

| Regulations | CySEC, DFSA, FSCA, FSC |

| Headquarters (HQ) | Cyprus |

| Founding Year | 2009 |

| Leverage Range | Up to 1000:1 |

| Minimum Deposit | $5 |

| Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Demo Account | Yes |

| Customer Service | 24/5 Multilingual support, with specific languages available 24/7 |

| Account Base Currencies | EUR, USD, GBP, CHF, JPY, AUD, SGD, PLN, HUF, ZAR |

| Deposit and Withdrawal Methods | Bank Transfers, Credit/Debit Cards, E-Wallets (Skrill, Neteller, Perfect Money) |

Introduction

Founded in 2009, XM has emerged as a globally recognized online broker, serving over 15 million clients across 190 countries. Known for its commitment to transparency, XM offers access to a wide array of financial markets, providing traders with competitive spreads and multiple account types that cater to different trading styles.

Operating as a market-maker, XM directly provides liquidity to its clients, enabling fast execution with no requotes or rejections. This ensures that traders can benefit from accurate pricing and commission-free trading on most account types, while enjoying the reliability of deep liquidity pools.

This review will cover XM’s key features, including its trading platforms, regulation, account types, and customer support, to help you determine if this broker aligns with your trading needs.

XM Regulation and Security

XM operates under a strong regulatory framework, ensuring a high level of security and transparency for its clients. The broker is regulated by several reputable authorities, including:

- Cyprus Securities and Exchange Commission (CySEC): Ensures XM complies with strict financial standards, offering client fund protection and full transparency.

- Dubai Financial Services Authority (DFSA): Reinforces the broker’s compliance with robust regulatory requirements in the Middle East.

- Financial Sector Conduct Authority (FSCA) in South Africa: Provides additional oversight, solidifying XM’s global regulatory presence.

- Financial Services Commission (FSC) in Belize: Strengthens XM’s commitment to maintaining high standards in the financial industry.

Client funds at XM are stored in segregated accounts, completely separate from company operations, offering protection against any misuse. Furthermore, the broker uses SSL encryption to safeguard personal and financial data, ensuring a secure trading environment for all clients.

XM Fees and Spreads

XM follows a transparent fee structure, ensuring traders are fully aware of the costs involved with trading. The broker offers competitive pricing across its account types, making it an attractive choice for both beginners and seasoned traders.

| Fees Type | XM Group |

| Inactivity Fees | Yes, $10 per month after 90 days of inactivity |

| Withdrawal Fees | $0, except for bank wire transfers under $200 |

| Spread Fees | Vary from account types; as low as 0.6 pips on certain accounts |

| Commission Fees | No, except for XM Zero Account, which has specific commission rates |

Spreads:

XM provides variable spreads starting as low as 0.6 pips for major currency pairs, such as EUR/USD, on standard accounts. For traders using the XM Zero Account, spreads can drop to 0 pips, with a small commission applied per trade. This flexibility allows traders to choose the cost structure that best aligns with their trading strategies.

Commissions:

Most of XM’s account types offer commission-free trading, with the broker earning revenue from the spread. The exception is the XM Zero Account, where a commission is charged in exchange for ultra-tight spreads. This model benefits high-volume traders who prioritize low trading costs.

Deposit and Withdrawal Fees:

XM does not charge fees for deposits or withdrawals, a key benefit for traders looking to manage costs efficiently. Additionally, XM covers all bank transfer fees for transactions over $200, ensuring that clients are not burdened with extra charges.

Inactivity Fees:

A $10 monthly inactivity fee is applied if an account remains dormant for more than 90 days. This fee can be avoided by ensuring regular activity in the account.

Swap Fees:

Traders holding positions overnight may incur swap fees, which are clearly displayed on the trading platform. XM also offers swap-free accounts for traders who follow Islamic finance principles, ensuring compliance with Sharia law.

XM Trading Platforms

XM offers access to two of the most widely used trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are designed to meet the needs of traders at different experience levels, providing an array of tools and features for efficient trading.

- MetaTrader 4 (MT4): Known for its intuitive design, MT4 is ideal for forex and CFD trading. It supports automated trading through Expert Advisors (EAs) and offers comprehensive charting tools, technical indicators, and one-click trading. XM provides MT4 in various formats, including desktop, web, and mobile versions, ensuring traders can manage their accounts from any device.

- MetaTrader 5 (MT5): MT5 is the upgraded version of MT4, with additional features such as more timeframes, advanced charting tools, and expanded asset coverage including stocks and futures. This platform is well-suited for traders looking to diversify their portfolio across multiple asset classes.

Both platforms are available across desktop, web, and mobile devices, ensuring that traders can stay connected and execute trades seamlessly, no matter where they are. In addition, XM offers its own XM App, providing traders with a custom-built mobile solution for quick access to the markets.

XM Account Types

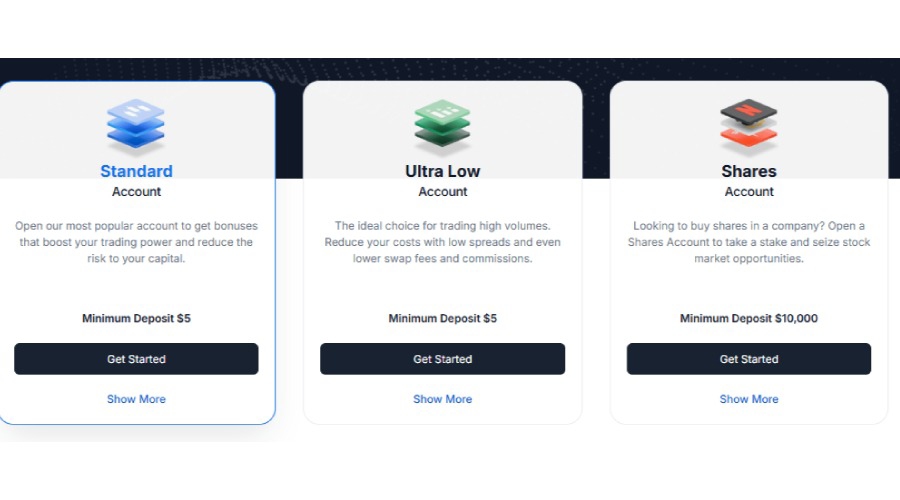

XM provides a variety of account types to accommodate traders with different needs and experience levels. Each account comes with distinct features, providing flexibility in trade sizes, costs, and market access. Traders can choose from the Standard, Ultra Low, and Shares accounts, but it’s important to note that the availability of account types depends on the XM entity under which you register. All accounts offer negative balance protection, hedging and Islamic options as standard.

Let’s take a closer look at these options:

Standard Account:

The Standard Account is designed to suit traders of all experience levels, offering both standard lot sizes (100,000 units) and a Micro Account option. The Micro option allows trading in micro-lots (1,000 units of the base currency), creating a low-risk environment ideal for beginners or for testing new strategies. Whether you prefer cautious trading with smaller volumes or larger trades for greater returns, this account adapts to your needs with competitive spreads, and access to a wide range of trading instruments. Additionally, the account includes an Islamic option, providing swap-free trading in compliance with Sharia law. Traders using the Standard Account are eligible for the XM Bonus scheme, with a minimum deposit of just $5.

Ultra Low Account:

The XM Ultra Low Account is perfect for cost-conscious traders, particularly those focused on major currency pairs, thanks to its reduced spreads and zero commission fees. This account offers both Micro and Islamic options, allowing traders to trade micro-lots (1,000 units of the base currency) for low-risk strategy testing or to enjoy swap-free trading in compliance with Sharia law. However, traders using this account are not eligible for the XM Bonus scheme, and the minimum deposit required is just $5.

Shares Account:

Designed specifically for traders focused on share trading, this account provides access to stock CFDs from top global companies, enabling traders to profit from market movements without owning the underlying shares. The account requires a minimum deposit of $10,000 and does not include the Micro account option or participation in the Bonus scheme.

Zero Account:

The XM Zero Account is exclusively available to traders registered under the European entity of the broker, regulated by CySEC. This account is tailored for those who value ultra-tight spreads starting from 0 pips, combined with low-cost, high-speed execution. A small commission is charged per lot traded, making it an excellent choice for scalpers and high-frequency traders seeking cost efficiency and precision.

Demo Account:

For those new to trading or wishing to test XM’s platform, the Demo Account offers a risk-free environment with virtual funds. It allows traders to practice strategies and explore the platform’s features before committing real capital.

Disclaimer: Disclaimer: Please note that Account types may vary between XM entities. Bonuses are not available for clients registered under CySEC and DFSA entities. For further information please visit XM website.

XM Tradable Instruments

XM offers access to a wide range of financial instruments, allowing traders to diversify their portfolios and take advantage of opportunities across global markets. With over 1,400 instruments available, XM ensures that traders have flexibility in their trading strategies.

Forex:

XM provides a broad selection of over 50 currency pairs, including major, minor, and exotic pairs. Traders can speculate on currency movements in the world’s largest and most liquid market, with tight spreads and competitive pricing.

Commodities:

Traders can also access a variety of commodities, including precious metals like gold and silver, as well as energy products like crude oil and natural gas. These instruments provide opportunities to trade based on global economic and geopolitical developments.

Indices:

XM offers CFDs on global stock indices such as the S&P 500, FTSE 100, NASDAQ 100, and DAX 30. These allow traders to speculate on the performance of entire markets or sectors, benefiting from market trends without owning the underlying assets.

Shares:

Through its CFD offering, XM gives traders the ability to trade on shares from major global companies like Apple, Amazon, and Google. This allows traders to take positions on the price movements of individual stocks without actually purchasing the shares.

Metals and Energies:

In addition to gold and silver, XM offers CFDs on other metals such as palladium and platinum, along with a range of energy markets. These markets can be highly volatile, offering numerous trading opportunities.

Cryptocurrencies:

Although availability may vary by region, XM offers trading in CFDs on popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading enables traders to speculate on this emerging asset class, though it comes with higher risk due to volatility.

Disclaimer: Products, services, and features advertised here vary between the XM entities. For further information, please visit the XM website.

XM Leverage and Risk Management

XM offers flexible leverage options, allowing traders to maximize their market exposure while managing risk. Depending on the asset being traded, leverage can go as high as 1000:1, giving traders the ability to control larger positions with smaller capital outlays.

- Leverage Levels: The leverage offered by XM varies depending on the financial instrument, the account type, and the regulatory entity overseeing the trader's account. For major currency pairs, leverage can be set as high as 1000:1, while other instruments such as shares or commodities may have lower leverage limits.

- Negative Balance Protection: XM offers Negative Balance Protection to all clients, ensuring that traders cannot lose more than the funds they have deposited. This important risk management feature provides a safeguard during periods of high market volatility, ensuring that traders' accounts do not fall into negative territory.

- Stop-Loss and Take-Profit Orders: XM supports key risk management tools such as stop-loss and take-profit orders, allowing traders to set automatic triggers to close positions at predefined levels. These tools help traders protect their profits and limit losses without constantly monitoring the markets.

XM’s leverage structure, combined with robust risk management tools, enables traders to optimize their trading strategies while controlling their exposure to risk.

Disclaimer: Leverage depends on the financial instrument traded and the respective XM entity with which the business relationship is established. The maximum leverage for clients registered under Trading Point of Financial Instruments Ltd (CySEC) and Trading Point MENA Ltd (DFSA) is 30:1. Bonuses are not available for clients registered under CySEC and DFSA entities.

XM Deposit and Withdrawal Options

XM provides a wide range of deposit and withdrawal methods, ensuring convenience and security for its global client base. The broker’s commitment to a fee-free transaction model and fast processing times makes managing funds efficient for traders.

- Deposit Methods: XM supports multiple deposit options, including credit and debit cards (Visa, MasterCard), bank wire transfers, and popular e-wallets such as Skrill and Neteller. Additionally, the broker allows local payment methods in certain regions, catering to the specific needs of traders around the world.

- Withdrawal Methods: Withdrawals can be made using the same methods available for deposits, ensuring flexibility and ease. XM strives to process most withdrawal requests on the same business day, with the time taken to receive funds depending on the payment method chosen. E-wallets typically offer the fastest withdrawal times, while bank transfers may take a few business days.

- No Fees for Deposits and Withdrawals: XM does not charge any fees for deposits or withdrawals, which is a significant benefit for traders. Additionally, XM covers all bank transfer fees for transactions over $200, ensuring that clients don’t face hidden charges when transferring funds.

- Minimum Deposit: The minimum deposit requirement at XM is as low as $5, making it accessible to traders of all levels. This low entry point allows new traders to start with small amounts while still enjoying the full range of XM’s services.

- Processing Times: XM is known for its fast and efficient processing of deposit and withdrawal requests. Most deposits are processed instantly, allowing traders to start trading right away. Withdrawals are generally processed within 24 hours, depending on the payment method.

- With flexible options, no deposit or withdrawal fees, and a commitment to speed and security, XM provides traders with a seamless and cost-effective experience when managing their funds.

Disclaimer: Deposit and withdrawal options offered by XM may vary depending on the country of registration.

XM Promotions and Bonuses

XM regularly offers various promotions aimed at boosting traders’ capital and enhancing their overall trading experience. These promotions can be especially beneficial for new clients or those looking to maximize their trading potential.

- No-Deposit Bonus: One of XM’s most popular promotions is the no-deposit bonus, which allows new clients to start trading without making an initial deposit. This promotion provides an excellent opportunity to test XM’s platforms and services with real market conditions, without risking personal funds.

- Deposit Bonuses: XM also offers deposit bonuses, where traders receive additional trading credit based on their deposit amount. These bonuses vary by region and time, so it’s important to check the availability of current offers.

- Loyalty Program: XM’s loyalty program rewards active traders by allowing them to accumulate points through their trading activities. These points can be redeemed for various rewards, including cash bonuses and trading credits.

- Region-Specific Promotions: XM frequently offers region-specific promotions tailored to local traders. These bonuses vary depending on the location and regulatory restrictions but provide additional trading incentives for clients in eligible regions.

While these promotions can boost trading capital, traders should always review the terms and conditions to fully understand any restrictions or requirements.

Disclaimer: Bonuses are not available for clients registered under CySEC and DFSA entities. For more information, please visit XM's website.

XM Education and Research

XM places a strong emphasis on trader education and research, providing an extensive array of tools and resources to help clients improve their trading skills and make informed decisions, all available in the members area of the platform.

- Webinars: XM offers free webinars in multiple languages, covering a wide range of topics from trading strategies to technical analysis. These sessions are led by experienced professionals and cater to traders of all skill levels, from beginners to advanced.

- Educational Videos: For those who prefer to learn at their own pace, XM provides a library of educational videos on trading concepts, platform tutorials, and market analysis. These resources are available to all clients, ensuring easy access to high-quality training.

- Market Analysis: XM provides daily market updates, technical analysis, and trading ideas through its dedicated research team. Traders can access insights on major markets, economic indicators, and upcoming events that may impact trading conditions.

- Economic Calendar: The platform’s economic calendar is a valuable tool for keeping track of important financial events such as central bank announcements, GDP releases, and employment reports. These events can create volatility in the markets, and being informed allows traders to adjust their strategies accordingly.

- XM Live Education Rooms: XM offers live educational sessions where professionals teach essential topics, including trading strategies, market analysis, and risk management, both for beginner and advanced traders.

By offering such comprehensive educational and research tools, XM ensures that its clients are well-prepared to navigate the markets confidently.

XM Customer Support

XM is committed to delivering top-notch customer service, providing clients with multiple channels to get assistance quickly and effectively. With support available in over 30 languages, traders from across the globe can access help in their preferred language.

- Availability: Customer support is available 24/7 via email, live chat, phone, instant messaging apps and more ensuring traders can get assistance during market hours. This global coverage ensures that XM clients have access to help no matter their time zone.

- Multilingual Support: XM’s team supports a diverse clientele by offering service in various languages, including English, Spanish, Arabic, French, German, Chinese, and more. This multilingual approach ensures that clients can communicate clearly and comfortably with the support team.

- Help Center: XM also features a comprehensive Help Center, where clients can find answers to frequently asked questions, platform guides, and trading resources. This 24/7 online support resource helps traders troubleshoot common issues without needing direct contact with the support team.

- Prompt Response: XM is known for its quick response times, especially through live chat, where most queries are addressed in real time. Email support typically receives responses within 24 hours, and phone support is also available for more urgent issues.

Whether it's platform issues, account queries, or trading-related questions, XM’s reliable and responsive customer service team ensures that traders receive timely and helpful support.

Conclusion: Is XM the Right Broker for You?

Since its inception in 2009, XM has positioned itself as a global leader in the forex and CFD trading space, catering to over 15 million clients across 190 countries. With strong regulatory oversight, robust trading platforms, and a wide range of tradable instruments, XM offers a comprehensive trading environment for both novice and experienced traders.

The broker’s flexible account types, competitive spreads, and zero-commission trading on most accounts make it a cost-effective choice. XM’s use of MT4 and MT5 platforms ensures traders have access to advanced tools, while its educational resources and market research provide valuable support in making informed trading decisions.

Moreover, XM stands out with its, secure transaction methods, and a commitment to client safety through measures like negative balance protection and segregated accounts.

However, as with any broker, traders should carefully evaluate their own risk tolerance and trading objectives. Leveraged trading can lead to significant profits, but it also carries the risk of larger losses, making it important to fully understand the risks involved.

Overall, XM is a well-regulated, feature-rich broker that offers a solid trading experience for traders at all levels, with strong security measures and a wide variety of market opportunities.

Disclaimer: Please note that Account types may vary between XM entities. For further information please visit XM website.

FAQ

Is XM a regulated broker?

Yes, XM is a fully regulated broker, authorized by multiple global regulatory bodies including the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), the Financial Services Commission (FSC) in Belize and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulations ensure XM adheres to strict financial standards, offering clients a secure and transparent trading environment.

What trading platforms does XM offer?

XM provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms in the industry. These platforms are available on desktop, web, and mobile devices, offering traders advanced charting tools, technical indicators, automated trading via Expert Advisors (EAs), and more.

What is the minimum deposit to open an XM account?

The minimum deposit at XM is just $5, making it accessible to traders with different budgets. This low minimum deposit applies to both the Micro and Standard accounts.

Does XM charge any deposit or withdrawal fees?

No, XM does not charge any fees for deposits or withdrawals. Additionally, XM covers all bank transfer fees for transactions over $200, ensuring that clients are not charged any hidden fees when moving funds.

What account types does XM offer?

XM offers five main account types: Micro, Standard, XM Zero, XM Ultra Low, and Shares Accounts. Each account is designed to cater to different trading needs, from beginners using micro-lots to experienced traders looking for ultra-tight spreads.

Disclaimer: Please note that Account types may vary between XM entities. For further information please visit XM website.

What are the spreads like at XM?

XM provides variable spreads that start as low as 0.6 pips on major currency pairs for most accounts. For traders using the XM Zero Account, spreads can drop to 0 pips, with a small commission charged per trade. The spreads vary depending on the account type and market conditions.

Does XM offer leverage?

Yes, XM offers flexible leverage options, up to 1000:1, depending on the financial instrument, account type, and the regulatory entity overseeing the trader's account. Higher leverage allows traders to control larger positions with smaller capital, but it also increases risk.For further information, please refer to the XM website.

Does XM offer a demo account?

Yes, XM offers a free demo account for traders who wish to practice their strategies or explore the platform without risking real money. The demo account replicates live market conditions, providing a risk-free environment to build trading skills.

What instruments can I trade with XM?

XM provides access to over 1,400 financial instruments, including forex, commodities, indices, shares, metals, energies, and cryptocurrencies. Traders can diversify their portfolios across various markets and asset classes.

How can I contact XM’s customer support?

XM offers 24/7 customer support via email, live chat and phone. Additionally, support is available in over 30 languages, making it easy for traders worldwide to get help in their preferred language.

Does XM offer any promotions or bonuses?

Yes, XM offers various promotions, including a no-deposit bonus for new clients and deposit bonuses that vary by region. The broker also runs a loyalty program where active traders can earn points that can be redeemed for rewards.

What risk management tools does XM provide?

XM offers several risk management tools, including negative balance protection, stop-loss orders, and take-profit orders. These tools help traders manage their risk exposure and protect their positions during volatile market conditions.

Disclaimer: Bonuses and flexible leverage are not available to clients registered under Trading Point of Financial Instruments Ltd (CySEC), Trading Point of Financial Instruments Pty Limited (ASIC), and Trading Point MENA Ltd (DFSA).

Europol warns crypto crime is evolving, with $40.9B illicitly received in 2024. Investigations face hurdles.

China eases rare earth export controls, halts chip probes. US pauses tariffs, extends exclusions. Soy deals boost agri sector.

Circle's Arc aims for on-chain finance with sub-second settlement & dollar fees. USDC bridges growth, especially in emerging markets.

Big Oil's 14% return lags S&P 500's 46%. Oil glut looms, while AI fuels nuclear & geothermal booms.

Amazon's earnings ignite Nasdaq! S&P 500, Nasdaq rally on AI hype & trade truce; weekly/monthly gains secured.

Mortgage rates dip to 6.17%, making $425K homes more accessible. Watch for Fed comments on future rate hikes.

Two-tier economy: High earners spend big (AmEx +8%), low-income consumers struggle. Valuations diverge.