Vantage

- Minimum Deposit 0-50

- Leverage 30:1, 2000:1, 500:1

- Regulation

Vantage Review: Is This Forex Broker a Good Choice?

Feature | Details |

Regulated by | ASIC, FCA, VFSC, CIMA, FSCA |

Founded | 2009 |

Headquarters | Australia |

Leverage | APAC: Up to 1:2000 GS: Up to 1:500 FCA & ASIC: Up to 1:30 |

Minimum Deposit | Standard STP: $50 RAW ECN: $50 Pro ECN: $10,000 |

Trading Platforms | MT4, MT5, WebTrader, Vantage App |

Tradable Instruments | 1,000+ assets (Forex, Stocks, Indices, Precious Metals, Soft Commodities, Energy, ETFs, Share CFDs, Bonds, Crypto) |

Demo Account | Yes |

Base Currencies | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, PLN |

Customer Support | 24/7 Multilingual Support |

Founded in 2009, Vantage is a well-established forex and CFD broker providing traders with access to over 1,000 financial instruments. The broker is regulated by multiple authorities, including ASIC (Australia), FCA (UK), CIMA (Cayman Islands), and FSCA (South Africa), ensuring a secure and transparent trading environment.

Vantage offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with its proprietary app and TradingView integration, catering to both beginner and experienced traders. With leverage up to 1:2000 (depending on region), low trading costs, and 24/7 customer support, the broker has grown into a globally recognized broker serving traders in multiple jurisdictions.

The broker’s commitment to tight spreads, fast execution, and advanced trading tools makes it a competitive choice for forex andCFD traders worldwide. This review of Vantage covers everything from regulations and platforms to fees and trading conditions, helping traders decide if the broker is a good fit for their trading needs.

Vantage Regulation and Licensing

Vantage is a well-regulated forex and CFD broker operating under multiple financial authorities, ensuring client protection and compliance with industry standards. The broker holds licenses from the following regulators:

Australian Securities and Investments Commission (ASIC)

Financial Conduct Authority (FCA) (UK)

Cayman Islands Monetary Authority (CIMA)

Financial Sector Conduct Authority (FSCA) (South Africa)

VFSC (Vanuatu Financial Services Commission)

These regulatory bodies impose strict compliance rules, including segregation of client funds, financial reporting requirements, and investor protection policies. This ensures they operate transparently and securely, offering traders a reliable trading environment.

Additionally, client funds are held in segregated accounts with top-tier banks, and the broker provides Negative Balance Protection, ensuring traders do not lose more than their deposited funds.

Vantage Trading Platforms

Vantage provides traders with a wide selection of powerful trading platforms, ensuring flexibility and access to advanced trading tools. Whether you’re a beginner or a professional trader, they offer multiple platforms to suit different trading styles:

MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

Industry-leading platforms with advanced charting tools, multiple order types, and automated trading viaExpert Advisors (EAs).

Available on Windows, Mac, WebTrader, iOS, and Android.

Supports hedging and scalping strategies with ultra-fast execution speeds.

Vantage App

A proprietary mobile trading app for iOS and Android, designed for seamless account management, trade execution, and market analysis.

Features real-time price alerts, customizable charts, and an intuitive user interface for on-the-go trading.

Vantage Copy Trading

Vantage Copy Trading is a feature that allows any trader to mirror the trades of experienced traders with proven track records. It’s an excellent way for new traders to learn about the markets and for those who have less time to observe the markets daily. Copy from as low as USD 50.

Disclaimer: Copy trading does not guarantee profits. Past performance of other traders is not a reliable indicator of future results. Only trade with funds you can afford to lose.

TradingView Integration

Provides advanced charting capabilities, technical analysis tools, and social trading features.

Ideal for traders looking for an interactive and visually enhanced trading experience.

ProTrader

A feature-rich platform for professional traders, offering custom indicators, advanced order execution tools, and deep market insights.

With fast execution speeds, deep liquidity, and multi-platform accessibility, Vantage ensures that traders can execute trades efficiently across global markets.

Vantage Account Types & Minimum Deposits

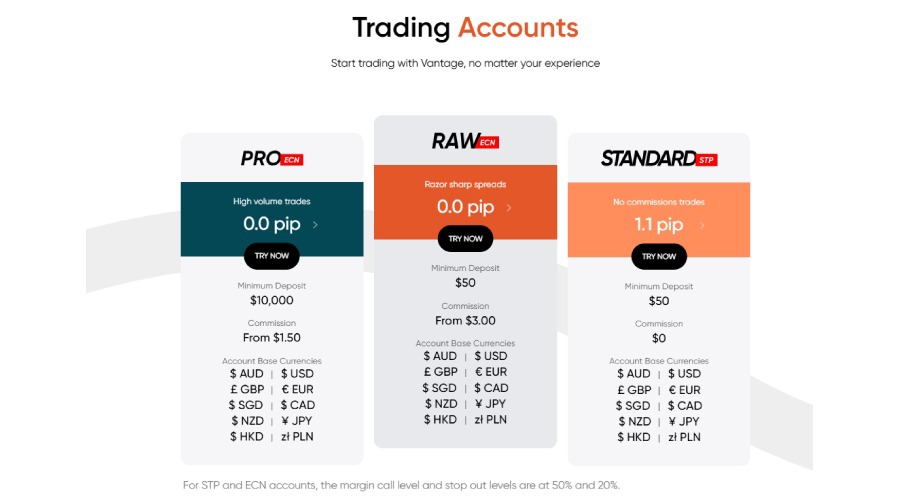

Vantage offers three main account types, catering to different trading styles and experience levels. Each account provides access to the same range of trading instruments but differs in pricing structure and execution model.

Standard STP Account (Best for Beginners)

Minimum Deposit: $50

Spreads: From 1.1 pips

Commission: $0*

Leverage: Up to 1:2000 (depending on region)

Execution Type: Straight Through Processing (STP)

RAW ECN Account (Best for Low-Cost Trading)

Minimum Deposit: $50

Spreads: From 0.0 pips

Commission: $3 per lot per side*

Leverage: Up to 1:2000 (depending on region)

Execution Type: Electronic Communication Network (ECN)

Pro ECN Account (Best for High-Volume Traders)

Minimum Deposit: $10,000

Spreads: From 0.0 pips

Commission: $1.50 per lot per side*

Leverage: Up to 1:2000 (depending on region)

Execution Type: ECN with deepliquidity and the lowest commissions

*Third-party fees may apply. T&C apply.

Demo Account

A risk-free demo account is available, allowing traders to test strategies with virtual funds before trading real money.

Vantage’s flexible account options make it suitable for traders of all levels, from beginners looking for commission-free trading to professionals seeking low spreads and high execution speeds.

Vantage Leverage & Margin Requirements

Vantage offers highly flexible leverage options, allowing traders to amplify their positions based on their risk appetite and regulatory restrictions. The available leverage depends on the trader's location and the regulatory body overseeing their account.

Leverage Limits by Region:

APAC (Asia-Pacific): Up to 1:2000

Global Standard (GS): Up to 1:500

FCA (UK): Up to 1:30 (due to regulatory restrictions)

ASIC (Australia): Up to 1:30

Margin Requirements & Risk Considerations:

Higher leverage allows for larger position sizes with a smaller initial deposit but also increases the risk of rapid losses.

Regulated clients (FCA & ASIC) have lower leverage limits to comply with investor protection regulations.

Negative Balance Protection (NBP) ensures traders cannot lose more than their deposited funds.

Margin Calls & Stop-Out Levels: Traders must maintain sufficient margin in their accounts to keep positions open, or their trades may be automatically closed.

Vantage’s flexible leverage structure makes it attractive for scalpers and high-frequency traders while ensuring regulated clients receive adequate investor protections.

Vantage Tradable Instruments

Vantage offers access to over 1,000 tradable instruments across various asset classes, enabling traders to diversify their portfolios.

Forex

Over 60+ currency pairs, including majors (EUR/USD, GBP/USD), minors, and exotics.

Tight spreads from 0.0 pips with RAW ECN accounts.

High leverage options available (up to 1:2000, depending on region).

Stock Index CFDs

Over 30+ global indices, including S&P 500, Dow Jones, NASDAQ 100, FTSE 100, DAX 40, ASX 200.

Low-cost trading with no commissions on index CFDs.

Deep liquidity and fast execution for index traders.

Stock CFDs

Over 800+ individual stock CFDs from major markets, including Apple, Tesla, Amazon, Google, and Meta.

Access to US, UK, European, and Australian markets.

Ability to trade long or short on stocks with leverage.

ETF CFDs

Over 50+ Exchange-Traded Funds (ETFs) from top global markets.

Trade ETFs on indices, commodities, sectors, and bonds.

Commodity CFDs

Over 20+ commodities, including gold, silver, coffee, wheat, and natural gas.

Low spreads and flexible leverage.

Bond CFDs

7 bond CFDs, including US Treasuries and European bonds.

A great option for traders looking to hedge risk.

Cryptocurrency CFDs

Over 60+ crypto pairs, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC).

Ability to trade crypto 24/7 with leverage.

No need for a crypto wallet—trade directly through their platforms.

Metals & Energies

Metals: Gold, Silver, Platinum, Palladium.

Energies: Crude Oil (WTI & Brent), Natural Gas.

Ideal for traders looking to hedge against inflation or geopolitical risks.

Vantage Fees & Spreads

Vantage offers a transparent and competitive fee structure, making it an attractive option for both beginner and professional traders.

Spreads

The broker provides variable spreads, depending on the account type and market conditions:

Standard STP Account: Spreads from 1.1 pips (Zero commission* and tight floating spreads).

RAW ECN Account: Spreads from 0.0 pips (Lowest ECN-based account commissions).

Pro ECN Account: Spreads from 0.0 pips (Experience PRO ECN Transparency).

Spreads on major forex pairs like EUR/USD and GBP/USD are among the tightest in the industry, especially with ECN accounts.

Commission Fees

Standard STP Account: No commissions.

RAW ECN Account: $3 per lot per side.

Pro ECN Account: $1.50 per lot per side.

Deposit & Withdrawal Fees

No deposit fees on most payment methods.

No withdrawal fees for bank transfers, credit cards, or e-wallets.

Third-party processing fees may apply depending on the method used.

Swap Fees (Overnight Financing)

Charged when holding positions overnight (varies by instrument).

Inactivity Fees

No inactivity fees—traders are not penalized for not trading.

Overall Fee Ranking:

✅ Low Spreads

✅ Zero Deposit & Withdrawal Fees

✅ Competitive Commissions for ECN Accounts

✅ No Hidden Charges or Inactivity Fees

With its low-cost trading environment, commission-free options, and zero hidden fees, Vantage is an excellent broker for traders looking to minimize costs and maximize profits.

Vantage Deposit & Withdrawal Options

Vantage offers fast and secure deposit and withdrawal methods, ensuring smooth fund transactions for traders worldwide.

Deposit Methods

Vantage supports multiple funding options, including:

Bank Transfers (Domestic & International)

Credit/Debit Cards (Visa, MasterCard)

E-Wallets (Neteller, Skrill, AstroPay, SticPay, Perfect Money)

Cryptocurrency Deposits (Bitcoin, Ethereum, Tether, etc.)

💰 Minimum Deposit:

Standard STP & RAW ECN: $50

Pro ECN: $10,000

🚀 Processing Time:

Instant for most methods (except bank transfers, which may take 1-3 business days).

No deposit fees charged by Vantage, but third-party processing fees may apply.

Withdrawal Methods

Withdrawals can be made using the same methods as deposits:

Bank Transfers

Credit/Debit Cards

E-Wallets (Neteller, Skrill, etc.)

Cryptocurrency Wallets

⏳ Processing Time:

E-wallets & crypto withdrawals: Processed within 24 hours.

Bank transfers & credit cards: 1-5 business days, depending on location.

💳 Withdrawal Fees:

No withdrawal fees charged by Vantage.

Third-party bank or payment provider fees may apply.

Security Measures

Segregated Accounts: Client funds are held in top-tier banks, separate from Vantage’s operational funds.

SSL Encryption: Transactions are protected with advanced security protocols.

KYC (Know Your Customer): Traders must verify their identity before withdrawing funds to comply with regulations.

Vantage’s wide range of deposit/withdrawal options, instant processing, and zero-fee policy make it a convenient broker for funding and withdrawals.

Vantage Customer Support

Vantage provides 24/7 customer support, ensuring traders receive assistance whenever needed. Their multilingual support team is accessible via multiple channels for quick and effective resolutions.

Support Channels

📞 Phone: Available in multiple regions for direct support.

💬 Live Chat: Instant support via the Vantage website and mobile app.

📧 Email: Responses within 24 hours for complex inquiries.

🌍 Social Media: Active on Facebook, Twitter, LinkedIn, and Telegram for updates and inquiries.

Multilingual Support

Support is available in 20+ languages, ensuring a global reach.

Assistance provided in English, Spanish, Chinese, Arabic, and more.

Vantage Academy

Vantage provides our clients with a comprehensive suite of educational resources through the Vantage Academy. Designed for traders at every level, from beginners to experienced professionals, the Academy offers a growing library of in-depth articles, video tutorials, and step-by-step guides covering essential topics such as fundamental analysis, technical analysis, trading strategies, and risk management:

🎓Webinar, Podcast & Educational Videos – Live and recorded sessions for all experience levels.

📊 Market Analysis – Insights with client sentiment, trading signals, articles, and news.

📖 Trading Guides & E-books – Covering technical and fundamental analysis.

Response Time & Effectiveness

Live chat response: Within minutes.

Email inquiries: Typically resolved within 24 hours.

Phone support: Quick connection times with knowledgeable agents.

Vantage Pros and Cons

Pros ✅ | Cons ❌ |

Regulated by multiple authorities (ASIC, FCA, CIMA, FSCA) for a secure trading environment. | Pro ECN account requires a high minimum deposit of $10,000. |

High leverage up to 1:2000 (depending on jurisdiction). | US traders are not accepted. |

1,000+ tradable instruments including forex, stocks, indices, commodities, and crypto. | Crypto trading is limited to CFDs (no actual asset ownership). |

Multiple platforms: MT4, MT5, Vantage App, TradingView, ProTrader. | |

Offers Copy Trading, allowing users to replicate the trades of successful traders. | |

Commission-free trading on Standard STP accounts. | |

No deposit or withdrawal fees (third-party fees may apply). | |

Fast deposits & withdrawals, with e-wallet and crypto transactions processed within 24 hours. | |

Negative Balance Protection to prevent traders from losing more than their deposited funds. | |

24/7 customer support via live chat, phone, and email. |

Conclusion

Vantage is a well-regulated forex and CFD broker offering a diverse range of trading instruments, competitive spreads, and advanced trading platforms. With support for MT4, MT5, TradingView, and the Vantage app, traders can access global markets with fast execution and flexible leverage options.

The broker provides multiple account types, including a commission-free Standard STP account for beginners and low-spread ECN accounts for experienced traders. High leverage (up to 1:2000) is available, depending on the trader’s jurisdiction, while fast deposits and withdrawals enhance the overall trading experience.

However, US traders are not accepted, and crypto trading is limited to CFDs rather than direct asset ownership. Additionally, the Pro ECN account requires a higher minimum deposit, which may not be suitable for all traders.

Overall, Vantage offers a secure and feature-rich trading environment, making it a suitable choice for traders looking for low-cost trading, strong regulatory oversight, and a wide range of assets.

Open an account here.

Rocket Mortgage offers grants up to $5K for renters, 1% down for buyers, but charges high loan fees. PNC offers grants up to $15K.

CBRL dips 3.1% on trade war fears; valuation concerns mount with 27.7% YTD loss.

Fed's Waller sees weak jobs, backs cautious 25bps rate cuts. Investors eye inflation vs. growth.

Consumer sentiment dips to 55.0 on jobs fears, ignoring shutdown. Inflation expectations ease to 4.6%.

Kalshi's valuation moons to $5B, Polymarket hits $8B on sports betting boom; traders eye regulatory risks.

Hyperliquid token down 22% monthly after $21M hack; traders eye $39 support vs. $69 ATH.

KLIC drops 5.2% on China tariff threats; SOX down 4%. AI demand fears hit Oracle, sparking broader tech sell-off.